The capital raising was well-timed, but competition is getting tougher

Published: March 18, 2020 at 1:31 p.m. ET, By Jeff Reeves

There are a host of questions on the minds of Americans as they watch their portfolios react to the latest coronavirus headlines. But while everyday investors are likely more concerned with their 401(k) balance and long-term savings, active traders are wondering when it might be safe to dive back in and recoup their losses with a well-timed swing trade.

And when these folks talk about swing trading for a quick profit, they invariable wind up talking about Tesla TSLA.

Let’s be clear about one thing up front: This global pandemic is unprecedented, as are the market disruptions that have come with it. As we have learned the hard way over the last month, previous sales forecasts or planned product launches mean squat in the face of lockstep declines for the entire S&P 500 index SPX. Heck, there are no guarantees that even well-capitalized blue-chip stocks will bounce back anytime soon, let alone a “risk on” momentum play like Tesla.

But as the old saying goes, in the short term the stock market is a voting machine… but in the long term it becomes a weighing machine. So how much heft does Tesla stock really have? And does it have what it takes to weather the current market crisis and revisit its recent highs anytime soon?

The case for Tesla

Well-timed capital raise: Back in February, Tesla raised $2 billion in a secondary offering of shares at a whopping $767. Considering Elon Musk & Co. would raise only about half of that figure at current prices, this well-timed move may prove one of the things that allows Tesla to stay on track. The cash was reportedly intended for capital spending through 2022, but at minimum will help keep operations stable at a tough time for businesses everywhere.

So far so good in China: In January, the much-anticipated production of China-built Teslas hit a snag as the coronavirus caused delays. But according to industry portal Inside EVs, Tesla bounced back in a big way to capture one third of the total EV market in China in February with sales of nearly 4,000 vehicles.

Now, a global economic slowdown will assuredly affect all auto makers — Tesla included. And February’s big splash may be in part because demand was pulled forward from January after delays. But the fact Tesla seems to be sticking to the Chinese growth plan that caused such optimism over the last several months is certainly encouraging.

U.S. operations still going: Believe it or not, Tesla’s plant in Alameda County, Calif., had stayed open as an “essential business” at full production up until this morning. The county sheriff now says it’s not essential and should only be open for “minimum basic operations,” but CEO Elon Musk surely has his own definition of what “minimum means.” He is on record saying the “danger of panic still far exceeds danger of corona” and that he “will personally be at work.” That’s a not-so-subtle message to both employees and shareholders that Tesla is doing everything it can to keep its operations running.

The icing on the cake is that Tesla is incredibly reliant on automation, as videos like this one show with their general lack of human workers. Unlike other auto makers that may be better served by simply going dark, Tesla’s problem is the same it has always been — how to meet big market demand.

The case against Tesla

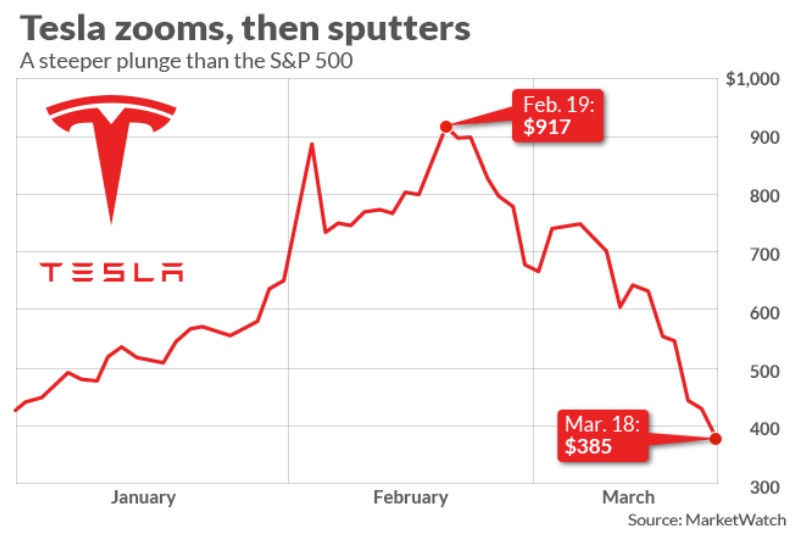

Momentum stinks: Volatility cuts both ways, and while it was fun to watch Tesla going higher simply because people thought it would go higher, the stock is now being punished because people think it deserves to be punished. The stock is down roughly 55% through Tuesday from its all-time high of nearly $970 a share. Worse is that unlike some stocks that have seen nibbles from bargain buyers, Tesla remains in a clear downward spiral, evidenced by its 3% decline on Tuesday despite a 6% rally for the S&P 500.

The stock was plunging more sharply than the S&P on Wednesday.

Financing will get harder: I’ll never forget the line from an analyst, quoted by Bloomberg, that “Tesla is not really seen as a growth story. It’s seen more as a distressed credit and restructuring story.” Consider that 2025 bonds issued by the auto maker only started trading at face value for the first time this year, to yield about 5.3%, amid the auto maker’s soaring stock price. In May 2019, the equivalent yield was 9.5%.

With havoc in the junk bond market and little chance of another cushy secondary offering in the near future, Tesla is quickly finding itself out of sweetheart funding options.

Competition is real: Even before this downturn, it was increasingly apparent that the rest of the auto sector is charging hard at eroding Tesla’s first-mover advantage. While Elon Musk & Co. are still scaling up, entrenched competitors are just as intent on switching over existing production capacity. Take BMW BMW, which plans to have 25 EV models on the road by 2023. By the way, it already has pretty decent bandwidth after selling more than 140,000 EVs across its BMW and Mini nameplates in calendar 2019.

Forget the coronavirus — the biggest threat to Tesla in 2021 could very well be the rest of the automotive sector.

Jeff Reeves is a MarketWatch columnist. He doesn’t own any shares in Tesla.

Source: www.marketwatch.com