The stock market today is looking a lot like it did a century ago, and if Great Hill Capital’s Thomas Hayes’s interpretation of the trendlines is on point, the bottom could be approaching.

Published: March 19, 2020 at 1:50 p.m. ET, By Shawn Langlois

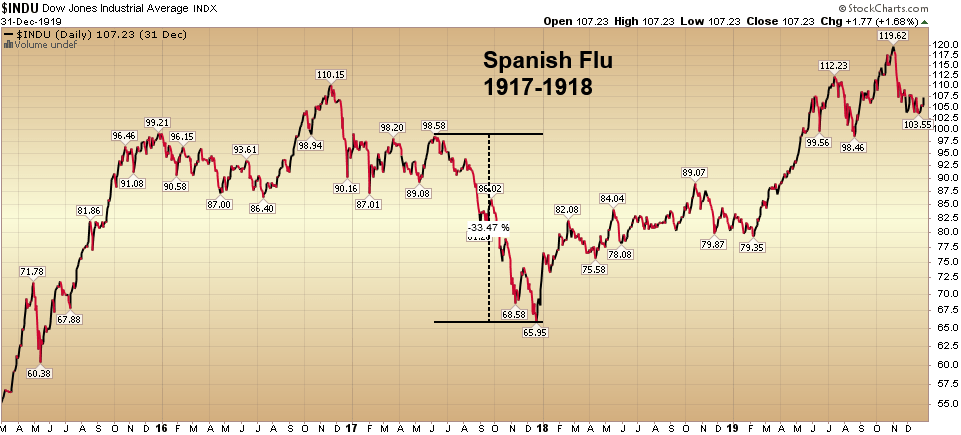

“Just as the market started discounting the worst case scenario in 1917,” he wrote, “it was already discounting a recovery months before the worst case scenario actually occurred in 1918.”

What was going on in 1917? The Spanish Flu was just starting to bubble up, with the deadliest month of the whole pandemic not hitting until October 1918 — by then, as you can see from this chart, the Dow Jones Industrial Average DJIA had already begun to heal.

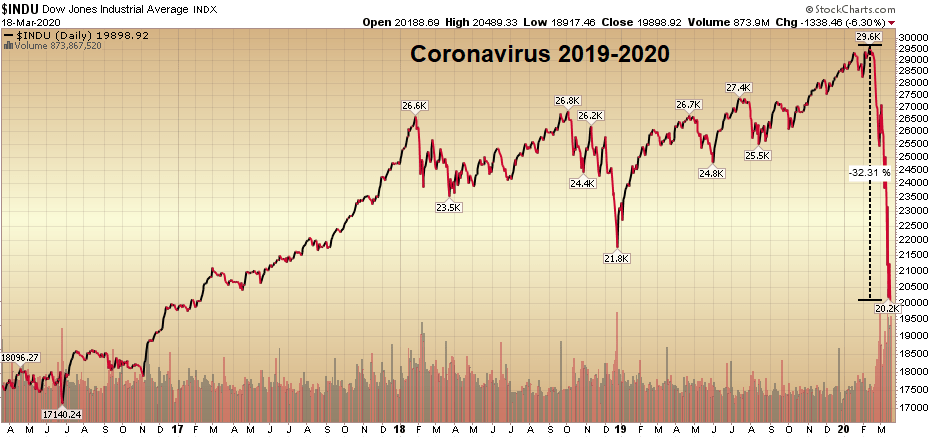

Hayes then posted this chart of the modern-day market plunge, noting that the nasty drawdowns amid the early stages of both pandemics were virtually the same.

“So while the worst was ahead in terms of the Spanish Flu in December of 1917, the worst was done for the stock market after the 33% drop,” Hayes wrote. “The difference [now] is that we have better medicine, methods and experience to mitigate the outcome.”

Of course, that doesn’t mean we’ll see that kind of rebound, but Hayes is hopeful.

“The market has already discounted a lot of pain based on its current drop,” he said. “It will be just as quick to discount a recovery once the initial shock subsides.”

Hayes explained that if the cases peak in the next few weeks and the stimulus package does its job, these current levels could look like a bottom in hindsight.

“If the virus goes on beyond what we have seen in China (in time), it is possible we could drop significantly more, but that is a lower probability,” he said. “There is no way to perfectly handicap this … but regardless of what the general market does in coming weeks, I see opportunity on a company by company basis now and am nibbling each ‘down’ day and sitting tight each green day.”

Read: Lessons from the 1918 flu can help us cope with today’s coronavirus pandemic

On Thursday, stocks were enjoying a relatively small bounce after the prior session’s beatdown, with the Dow and the S&P 500 SPX up about 1% each. The Nasdaq Composite COMP was faring much better, up more than 3%.

Source: www.marketwatch.com