As shown over the past 12 years, the Fed is content to inflate the stock market and wait for the economy to catch up

Published: April 9, 2020 at 12:35 p.m. ET, By Simon Maierhofer

Five months ago, the Nasdaq-100 broke above significant resistance and staged one of the most persistent rallies ever. After nearly reaching its target, it hit a major air pocket and is now back at the same resistance. This time it’s even been reinforced.

Money makes the world go round, and on Wall Street there’s nothing more important than money. Stocks follow the money, for better and for worse. That’s why every investor should ask: How much money is there? And where is it going?

So how much money is there? In short: Too much to ignore. Federal Reserve Chairman Jerome Powell vowed to “provide as much relief stability as we can.” In the past month, the Fed has dropped interest rates to zero, begun buying Treasurys and mortgage debt, and started an array of lending programs. On Thursday, the Fed said it would provide an additional $2.3 trillion in loans, including those for mid-sized companies and aid to states and cities.

That, by far, exceeds the Federal Reserve’s response to the last financial crisis a decade ago.

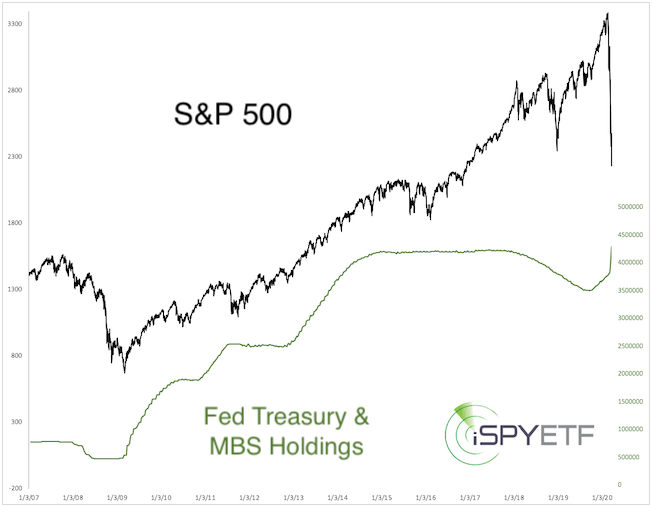

The chart below, originally published in the March 26 Profit Radar Report, shows the correlation between the S&P 500 SPX and the Fed’s balance sheet (Treasury and mortgage backed securities ((MBS)) holdings.)

It’s hard to deny the correlation between Fed liquidity and stock prices.

Where is the money going?

Before ascertaining where the money is going, it helps to know where the money currently is.

Money has rushed into CDs, savings, checking, money market and other cash equivalents at a record pace.

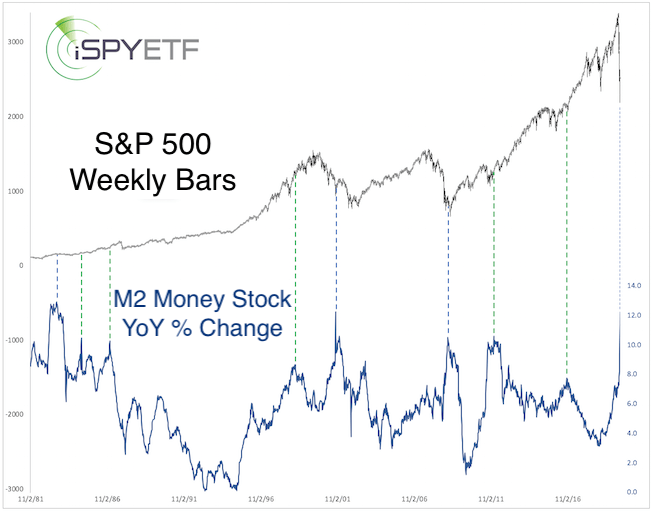

How do we know? The M2 money supply, which tracks money in CDs, savings, checking, money market, etc., has never before spiked that quickly and that high (see chart below).

It’s probably safe to assume that panicked investors yanked money out of stocks and stuffed it into cash or cash equivalents. In times past, this kind of behavior was usually seen at major bottoms (with the exception of 1982 and 2001).

Does a rising tide lift all boats?

To sum up: The Federal Reserve is actively pumping lots of money into the system, and there’s plenty of cash on the sidelines.

Many bright minds claim that trillions in stimulus is not enough to restart the post-coronavirus economy, and they may be right. But there’s a different between the stock market and the economy.

As the experiment with quantitative easing in 2008 and thereafter showed, the Fed is content to just inflate the stock market and wait for the economy to catch up many years later.

Courtesy of the Federal Reserve, rising stocks and a shrinking or stale economy are not mutually exclusive.

Via the March 22 Profit Radar Report, I pointed out strong technical S&P 500 support at 2,190-2,130 points and said: “It is quite possible that the S&P 500 will jolt higher from the 2,190-2,130 range, and aggressive traders may act accordingly.”

Stocks bottomed the next day, and since then the S&P 500 rallied 23% and the Dow Jones Industrial Average DJIA spiked 26%. The same is true for the corresponding ETFs, the S&P 500 SPDR Trust SPY and Dow Jones Industrial Average ETF Trust DIA.

The stock market’s initial response to Federal Reserve liquidity is not surprising. A retest of the March panic low is still possible, but stock market returns for the remainder of 2020 and 2021 are likely to exceed expectations.

In the short term, as discussed here, the Nasdaq-100 and Invesco QQQ Trust QQQ are trying to break and stay above triple resistance. The price action here could set the stage for the days and weeks to come.

Simon Maierhofer is the founder of iSPYETF and publisher of the Profit Radar Report.

Source: www.marketwatch.com