Critical information for the U.S. trading day

Published: April 13, 2020 at 10:20 a.m. ET, By Barbara Kollmeyer

With the long Easter weekend behind us, stocks are pointing to a lower start for Monday as coronavirus fallout swings into focus.

A big question to start the week is whether investors have gotten ahead of themselves, after the S&P 500 managed its best weekly gain in 45 years as the Federal Reserve threw more money at the economy. Banks may have something to say about that Tuesday as they kick off earnings season, shedding light on the damage that’s been done so far by the virus.

Our call of the day, from a team of Goldman Sachs strategists led by David Kostin, says the worst of the market rout is behind us. A “previous near-term downside of 2000 [for the S&P 500] is no longer likely. Our year-end S&P 500 target remains 3000 (+8%),” says the team in a note to clients on Monday.

Why? “The combination of unprecedented policy support and a flattening viral curve have dramatically reduced downside risk for the U.S. economy and financial markets and lifted the S&P 500 out of bear market territory,” said Kostin, whose gloomy stock prediction from last month came the day before a complete market meltdown.

“If the U.S. does not experience a second surge in infections after the economy reopens, the ‘do whatever it takes’ stance of policy makers means the equity market is unlikely to make new lows,” said Kostin.

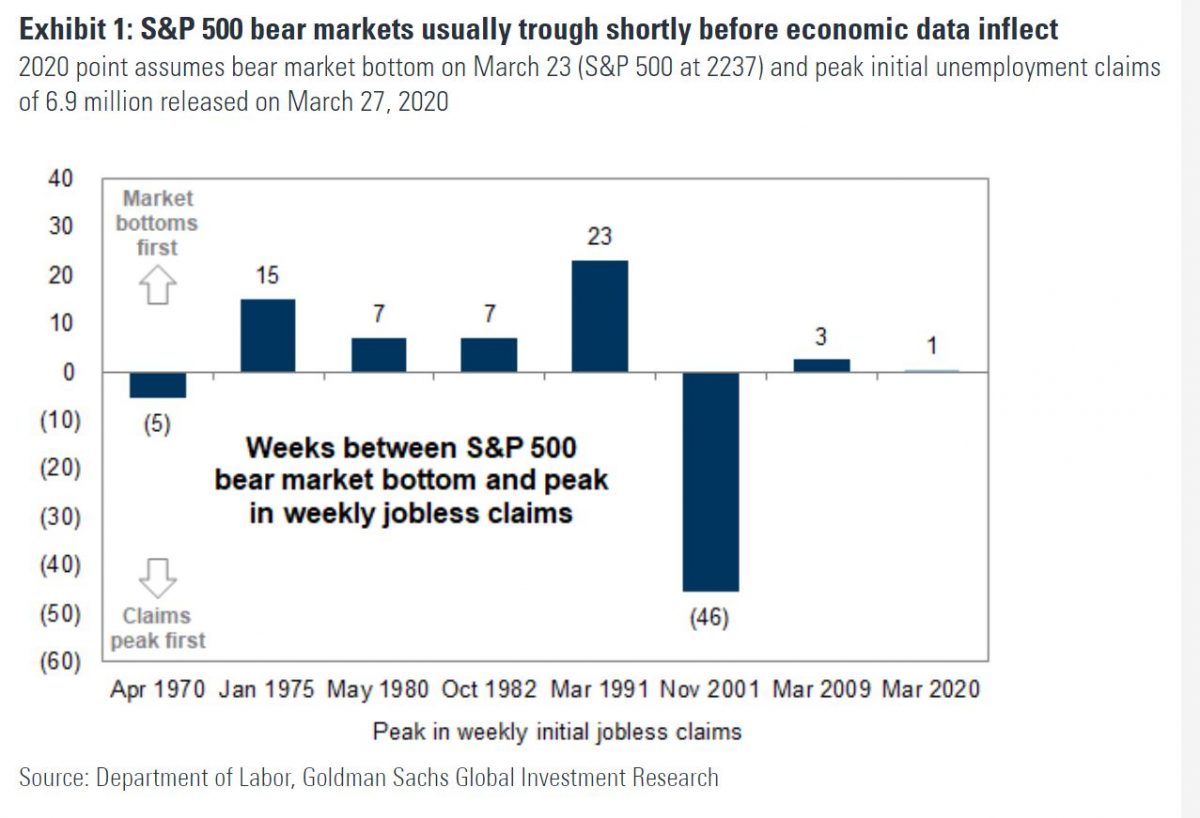

They also argue, as their chart shows, bear markets usually bottom before economic data’s nadir:

And Goldman is in the camp that believes bleak quarterly earnings to come matter less than earnings per share for 2021. Still, it’s a bit of marked confidence at a time of so many unknowns and no global light switch to turn the world’s economies back on.

Here’s JonesTrading’s chief market strategist Michael O’Rourke with a comment to balance out all that positivity:

“Although the pandemic progress of the past week and the Fed programs are not exactly one-off events, they won’t be repeating on a daily basis as disappointing earnings and economic data will be for the next couple of months. No matter how active the Federal Reserve is, this is not a tape to chase higher.”

The market

The Dow US:DJIA , S&P US:SPX and Nasdaq US:COMP are in the red, while oil prices US:CL00 are back in the black after Sunday’s production-cut deal. European markets are closed for an extended Easter break. The Nikkei JP:NIK and KOSPI KR:180721, which led a mostly down day in Asia.

The chart

Coronavirus-stimulus won’t be enough to repair a damaged market, says Octavio Costa, Crescat Capital’s portfolio manager. Here’s his chart:

Just math.

Global stocks lost about $20T in value so far.

The real damage, including all other assets, is probably closer to $50T.

Add a $13T dollar shortage problem globally.

You think $6T of money printing & broke governments will fix this?

I will take the other side. pic.twitter.com/EIcwms8o5V

— Otavio (Tavi) Costa (@TaviCosta) April 12, 2020

Source: www.marketwatch.com