Summary

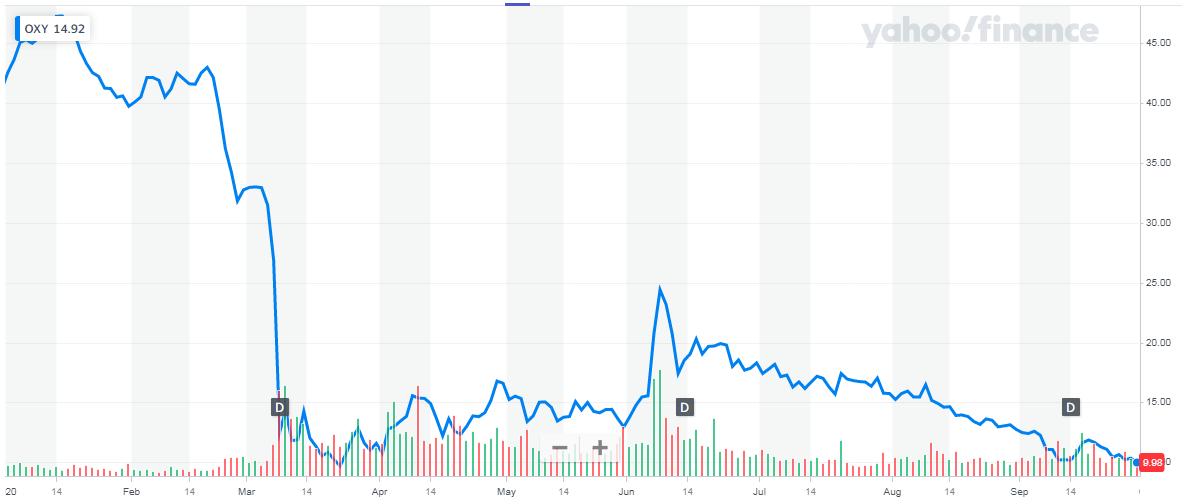

- Occidental Petroleum is not just an oil and gas company anymore.

- The company is leveraging decades of experience managing carbon dioxide into new business ventures with a capital-light approach taking joint venture partners that bring something to the table.

- We think Occidental can be bought at present levels by risk-tolerant investors for future growth and income.

Introduction

Anyone want to read another doom and gloom article on Occidental Petroleum (OXY)? I didn’t think so.

I’ve got good news, you’re not going to read one here. This article will have a very specific focus, so I am going to link another very positive article on OXY, as it covers all the oil and gas and financial business I am going to skip in this article.

I have written extensively on this company since mid-2019. I initially fell under the spell cast by the spectacular assets Occidental Petroleum acquired from Anadarko, along with the potential of the promised synergies and divestiture program for non-core assets. This allowed me to look past the monumental debt the company racked up in so doing. In a scenario where oil prices continued the upward trend they were exhibiting at the time of this deal, I would be a bit ebullient as I looked back on it.