Most sentiment gauges are pessimistic, which is bullish for stock prices — to a point

新闻

Biotechnology experts who understand both science and investing are skeptical of the stock market’s strength

The pandemic’s damage to the economy, and investing markets, may be long-lasting and worse than expected, they say

‘We’ve seen the lows in March’ for the stock market, says man who called Dow 20,000 in 2015, ‘and we will never see those lows again

‘I think 2021 could be a boom year,’ says Wharton professor Jeremy Siegel

Dow ends week 455 points higher, shaking off the worst U.S. unemployment rate since the Great Depression

U.S. Labor Department data show 20.5 million out work, unemployment rate hits 14.7%

Buy in May? Analyst who called the March bottom says current pullback is just a bull-market pause

A correction was ‘overdue,’ but investors should use weakness to add to their stock portfolios, says Morgan Stanley’s Michael Wilson

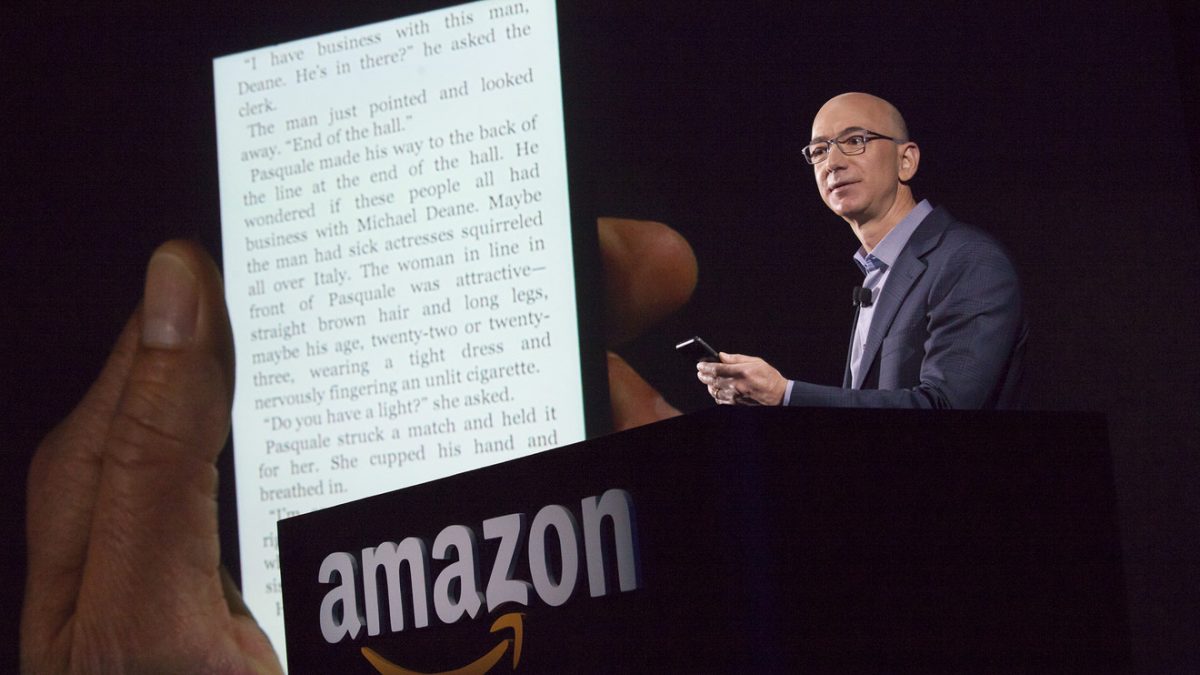

Amazon’s CEO tells investors ‘you may want to take a seat,’ as he explains why the company will spend ‘entirety’ of $4 billion profit

Jeff Bezos: ‘We are inspired by all the essential workers we see doing their jobs — nurses and doctors, grocery store cashiers, police officers, and our own extraordinary frontline employees’

‘Bond King’ warns the stock market could hit new lows amid ‘social unease’

‘I’m certainly in the camp that we are not out of the woods. … I think a retest of the low is very plausible.’

The ‘Great Repression’ is here and it will make past downturns look tame, economist says

David Rosenberg is often considered a permabear, but that’s not entirely true

‘Don’t be fooled!’ A 40% drop could hit by next year after this bear-market rally fades, veteran economist warns

‘This looks like a bear market rally, similar to that in 1929-1930’

Will the stock market tumble back to its coronavirus lows in March? About 92 years of S&P 500 history says there’s a good chance

Since 1928, reviewing the past 25 bear markets, there has been a lower price put in by the S&P 500 index 60% of the time