A master reset at the loss-making and debt-laden AirAsia X Bhd (AAX) has been a long time coming.

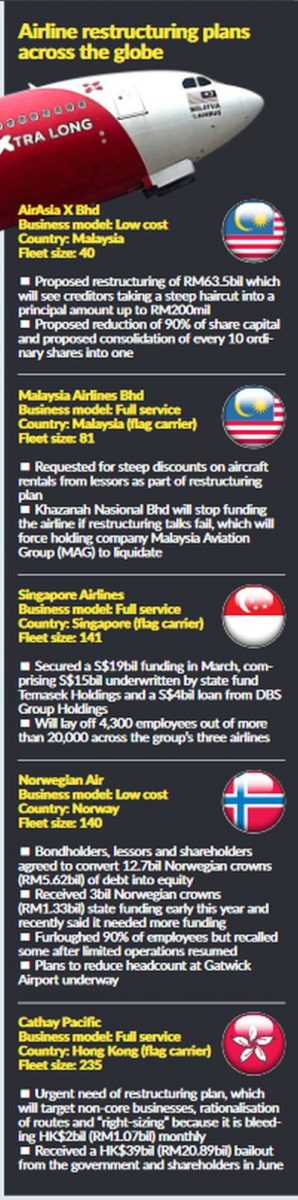

It could have dragged its financial woes on and on but the Covid-19 pandemic, which has thrashed the aviation industry globally, may very well have forced the hand of low-cost, long-haul associate of AirAsia Group Bhd. It could still be a blessing in disguise, depending on how the restructuring plan for its RM63.5bil debt turns out.

The pandemic, which has grounded the airline’s entire fleet since the second quarter of 2020, has delivered the hard reset button to AAX to do some soul searching and to right its wrongs before it prepares for take-off again.

From the very beginning, sceptics had doubted whether a business model of a long-haul budget airline would work, seeing how the late Sir Freddie Laker’s Skytrain went bust in the 80s.

Thirteen years down the road, it would seem like AAX might go down the same road and prove its critics right.

Ever since it went public in 2013, it has only been profitable in 2016 and 2017. It made its debut on Bursa Malaysia at RM1.26, and as of yesterday, the share price closed at a mere four sen.

As of the first half ended June 30 this year, AAX had raked up accumulated losses of RM854.94mil.

Will AAX rise again from its ashes, or will this be the fatal blow that sends the airline to its untimely demise?

Former investment banker and chartered accountant Datuk Lim Kian Onn, who was recently redesignated as the airline’s deputy chairman, has been tasked to pilot the airline out of the turbulence.

He speaks to StarBizWeek’s Jagdev Singh Sidhu and Royce Tan on how he plans to navigate AAX through its darkest period.

First of all, RM63.5bil is a large figure. How did AAX amass that sort of debt? The RM63.5bil we see as being the total crystallised liabilities is a snapshot of all kinds of liabilities, actual and contingent, and is a figure we had to capture for the purposes of the scheme of arrangement. What we actually owe at this stage in terms of actual liabilities is RM2bil, which is still a big figure. The larger balance represents contingent liabilities that have now crystallised as a result of the scheme, whether we like it or not.

In other words, we will not be able to honour our commitments going forward. These are all the lease payments for the next eight to 10 years and the purchase price of the planes we ordered for the future, the contracted engine maintenance by Rolls Royce for the remaining life of the planes and so on. For the purpose of the scheme, these contingent creditors have to be uniformly accounted for.

Your plan calls for a severe haircut, with creditors only getting a fraction of what they are owed. Even if you factor in that your actual liabilities are RM2bil, the haircut is still a massive 90%. How did you arrive at that plan?

The starting point is that the company needs fresh capital. We have run out of money. Whether this money comes from existing shareholders or new shareholders or from banks, we need capital. Obviously, banks will not finance the company without shareholders, both old and new, putting in fresh equity. So, a prerequisite is fresh equity.

We looked at the business plan and calculated that we need up to RM500mil to jumpstart the airline. We had to make certain assumptions on how Covid-19 will pan out. In this case, we made the conservative assumption that it will be a slow recovery to normalcy. We have not made any assumptions on government help.

It would be nice to get some, but we can’t count on it at this stage.

Then we ask ourselves what sort of a balance sheet the airline needs to have before we can persuade investors to part with their money. Investors are spoilt for choice and unless we stand a good chance of success, they will not put in money.

In the restructuring proposal and depending on the accounting treatment for a couple of items, our shareholder funds post-restructuring after all the haircuts are between a negative RM200mil and a positive RM200mil. Most likely, shareholder funds will be zero. If there is a more generous scheme with a smaller haircut, the shareholder funds before new equity injection could be RM1bil in the negative. In that situation, we will not be able to get anyone to put in money.

If we find RM300mil in new equity, then the shareholder funds are RM300mil at the restart of business and if we are able to borrow RM200mil, we feel that we will have a good platform to start all over again

Isn’t it a prerequisite in most of these restructurings that existing shareholders commit to refinancing the airline before creditors will consider supporting the scheme? Shareholder funds have been written down to nothing. We have to build a case for existing shareholders to want to put in more money. Just as we have to build a case for new investors to replace existing investors who might not want to invest. Other than the Tune group, we have thousands of smaller shareholders each owning a small number of shares and we cannot go to them unless we have a plan. Tan Sri Tony Fernandes and Datuk Kamarudin Meranun founded the airline and they will of course want to support the restructuring and recapitalisation. They are very committed. It’s their baby. But do we wait for everyone to confirm first before we clean the balance sheet up? Let’s do everything concurrently.

How has the initial negotiations with creditors been so far? It has been tough. There are many lessors, some very big ones too. There is Rolls Royce and of course there is the giant Airbus. We have been talking to them for two months. All of them are understandably upset. We put our hands up and say we are guilty. We owe you money. I would be aggrieved if I were them.

There are analysts and news reports that suggest creditors, particularly lessors, have no choice but to agree to our scheme. That’s not true. They have choices. One of our lessors recently took back one of the planes for conversion into a freighter. There are alternative uses for these planes.

What we have to do is convince the lessors that we are their best bet to provide the best economic returns for their planes in that eight- to 10-year horizon. If we are still around and assuming that there is some form of return to normalcy in the next couple of years, we will be in the best position to maximise utilisation of their planes and provide them the best returns. So, we have to present our business plans to them and let them see whether it makes sense for them to continue leasing their planes to us. When we started the discussions a few months ago, we planned for flights to resume in October. That’s no longer possible. Now we are planning for the first quarter. Who knows whether we can, so it’s a very dynamic process.

Are they likely to accept the proposals? We will see. We believe we have built a convincing case. But the lessors are all looking at the proposals through different lenses. A couple of them are very big. One has four planes with us but they have a fleet of 500 worldwide. Their priorities may be different from a smaller lessor who may not be able to redeploy their planes with the same efficiency.

But I have this to say. All of them, while upset at this turn of events, have been incredibly polite and constructive in all our discussions. And all of them genuinely want to find a common ground to take the airline forward. No one has anything to gain from our demise.

How do you propose to deal with the lessors, Rolls Royce and Airbus, if you are successful in your restructuring? You have referred to those who are not only our creditors but our essential business associates. Our airline needs the lessors, Rolls Royce and Airbus, in order to survive and if we are successful in our restructuring exercise, we also need them in order to thrive. The scheme that we have started has to deal with all our unsecured creditors uniformly and on a pro-rated basis and we are mindful not to prefer or unfairly prejudice one group of unsecured creditors over another.

But we also need to plan for the future if the scheme is successful and what we have done is to discuss possible frameworks going forward. What kind of lease arrangements they might want to see in a restructured airline… how many planes they will want to leave behind with us and so on. We have been very honest with them on what we think we can do and what we can’t do. Rolls Royce, for example, is our only provider for engines and we all understand that we need to be realistic on what the costs and charges are if we are to make it.

How is AAX going to raise capital to stay afloat? As I said, new equity is definitely required. We can only do this if and when the balance sheet is cleaned up. Some lessors have asked us whether we have equity investors lined up. But really, it’s a chicken-and-egg situation. Restructuring comes first. We have spoken to potential new investors and there is good interest. There most likely will also be capital raising from existing shareholders to give everyone a chance to recover their investment. We haven’t discussed this in-depth at the board but indications are that it will be a combination of equity from new and old shareholders. But only if there is a cleaned-up balance sheet

What if push comes to shove and the creditors vote otherwise, which would ultimately see AAX being liquidated? Is there any other alternative?Creditors have asked for better terms. They want fewer haircuts and taking the cue from the restructuring of Norwegian airlines, they want free equity in exchange for forgiven debt. (We can only do it) if we can find new investors that are prepared to put in fresh equity in a company that has negative shareholder funds and at same time have their shareholdings immediately diluted by free shares or warrants given to creditors. Unfortunately, that kind of money is not there and I think all the creditors appreciate this difficulty. So, it is not possible to offer free equity. What is the long-term plan to turnaround the airline? Is there a target of when AAX is expected to return to the black?With Covid-19, it’s a whole new world. Over time, travel will return. It may take some time but it will. But the two biggest cost components in running an airline representing 70% of our cost have more than halved. While we were paying lease rates of up to US$800,000 to US$900,000 a month for our planes, the current lease rate is only US$250,000 to US$300,000. The oil price has more than halved and we believe that we have seen peak oil demand. On top of that, there is no longer inflationary wage costs.

Before this, we expanded rapidly in developing new routes. We added frequencies. But in the future, it will be a more focused business plan. Concentrate on the medium-haul routes that make immediate returns. Improve productivity. The first three years will see us shrinking our fleet significantly. Getting our profits up will be our priority, not market share.

We have taken a conservative view in projecting passenger demand. On the other hand, if a vaccine is found, the pent-up demand for travel will be explosive and we will be very nicely positioned with enough planes to meet all that demand. We should be very profitable if this happens.

The airline has a choppy track record. Other than a couple of years of profitability, it has been making losses. Were there mistakes?

With the benefit of hindsight, it’s a 20/20 vision. We should not have hedged oil, we grew too fast, we should have discounted the robust Asian travel growth forecasts, we did not anticipate the extent of Covid-19. But yes, we could have done better. We should have been more focused. Maybe tighter control on costs.

But there was also irrational competition. Sometimes, premium airlines’ business class fares were much cheaper than our breakeven fares even though our cost base is much lower.

We learnt from our mistakes. Three years ago, our hotel group was doing badly. Fast forward, all our hotels are trading at breakeven or near breakeven even in these difficult times. Last month, our Ormond Chow Kit was voted National Geographic’s best new hotel in the world in its class. Our Tune hotel was Asia’s best airport hotel in 2019 and we hope to repeat that this year. Our hotels in JB and KK are Tripadvisors’ number one hotel in their respective cities.

We think we can also do better at the airlines if we get through this mess.

What are the stumbling blocks in the negotiations and how is the global situation surrounding airlines influencing your negotiations?

It’s in managing the conflicting demands of all the different parties. What is good for one lessor may not be good for another. What’s good for lessors may not be good for Airbus. One lessor asked for assurance that we won’t go immediately out and buy new Airbus planes. Some may argue they are different from the rest and want to negotiate a better deal for themselves. But that’s not possible. It will open a floodgate of competing requests and it will take years to sort each legal case out.

Deals that are cut with other airlines are often used as templates by the lessors. But each airline is different. Some are stronger than others.

How important is it to get travel going again besides the status of your negotiations?

It’s everything. No travel, no revenue, no airline. No one can survive an indefinite shutdown. So, our fundraising is predicated on a recovery, slow as it may be.

How many staff does AAX have and what will be the impact on the local industry and economy should AAX fold? What has been AAX’s contribution to the economy?

Two years ago, we had 2,300 staff. We have lost 1,000. The rest are on furlough with significant pay reductions.

A year ago, the AirAsia group commissioned an independent study on the whole group’s contribution to the economy.

First, on the group as a whole. The number of passengers that travelled with AirAsia is estimated to make up 2.2% of all air passengers globally. The economic footprint is vast. AirAsia supports employment, stimulates spending and has a significant contribution to gross domestic product (GDP). Spending by visitors on AirAsia-facilitated trips has a wider impact as additional GDP and jobs are sustained in the tourism sector’s supply chain.

The connectivity benefits are significant too. Greater connectivity underpins international business and ultimately increases productivity. Specifically to AAX, based on their research findings, airfares between KL and Sydney are 16.2% lower due to AAX’s existence. By reducing the average price of flying between KL and Sydney, AAX’s existence has made it possible for more people to fly. Specifically, they estimate that 59,000 more passengers travelled between the two cities in 2018 due to AAX. Think of the multiplier effect.

The total economic impact of the whole AirAsia group made up of both core and tourism related amounted to US$6.2bil in 2018 and accounts for 304,000 jobs. That’s a lot. Is Thai and Indonesia AAX covered by your restructuring? We are liquidating Indonesia. The planes are back with us. We have a 49% stake in Thai AAX. It has been written down completely in our books. They have 15 planes, six of which are subleased from us and as part of the scheme, the lessors will contract directly with them. They are also looking at various options and we will work with them in this exercise but they are not part of our scheme.

Should AAX get the restructuring it needs, what then will be the next steps it will need to take to preserve the airline? Will there be more cuts?

It will be a whole new start. We will have to re-negotiate every single contract. Some vendors may not want to deal with us anymore. At that time, we will have better visibility as to when we can fly and how long it takes to get back to normality, hopefully. So, we will cut our cloth to suit our needs at that time.

We have to look after everyone’s interest including the shareholders that have put in new money and we will do our best to look after all stakeholders’ interest. But we really hope that we will be in a position to take on more staff to meet what we hope will be pent-up travel demand. But at this time, it’s anyone’s guess.

Who are the other parties involved in the debt-restructuring exercise? What about Malaysia Airports? Lots. Paramount to all this and we have made specific emphasis in all our public announcements, we want to take care of the thousands of passengers who have bought tickets and are not able to fly. Technically, everyone is a creditor but we wish to convert their tickets for flight credits to be used into the future without restrictions.

Then we have all the airport authorities including Malaysia Airports. There was a CIMB report the other day that said the demise of AAX will cost them RM254mil every year. That’s a big figure. At the best of times, we struggled to make anywhere near that. So, the airport business is a much better business than the airline. We have had a rocky relationship in the past. We hope they will now hold our hands as we find our feet, maybe consider some initial concessions as we learn to walk again. In some airports, they pay us to fly there as they make money elsewhere from passenger spending. But to be honest, that may be a bridge too far here. We want to explore how we can have better synergies and work to a mutually beneficial long-term goal. We hope to meet them soon.

How will the negotiations proceed in terms of importance and acceptance, as there are a lot of different parties involved?

There is a defined timeline. We have asked the court for a hearing to allow us to convene a court-sanctioned meeting of creditors to vote on the scheme. We hope to get all meetings done before the year ends. We have had extensive discussions already with all the major creditors and we will continue to engage them. All of them are important.

What will be needed to pull off the debt-restructuring exercise as it does involve many suppliers, lessors and future aircraft purchases? Cool heads and lots of hard work. We have a great team. A forward-looking board with Tan Sri Rafidah Aziz and the co-founders Fernandes and Kamarudin providing very good guidance. Benyamin Ismail leads a super-charged senior leadership team that is very experienced. We even have someone from the Malaysia-Singapore Airlines (MSA) vintage. And in there, most importantly, is our future, some very bright and young budding leaders who have stepped up to the challenge. Our advisers come from small boutique firms and are all very personally committed. So, we have the ingredients. Very importantly too, we have creditors that are prepared to sit with us to help chart our way forward. So far, the big ones have been very good.

Will previous legal issues with Airbus influence the decision-making process at Airbus? We can’t tell you what’s on their mind. Maybe, it will be a positive influence. Maybe, they feel some remorse. The legal issues contributed to where we are today and there are blemishes on our reputation. But we think they are astute enough to realise that they are better off with us still being around. We are one of the biggest users of Airbus planes and specifically on the A 330, we are their largest customers.

We have had good discussions in recent weeks with them. They flew to KL and got themselves quarantined to meet us. So, they are very committed. But they also have bosses in Toulouse who may not see our point of view. It’s a big organisation. Let’s see.

Malaysia Airlines did not manage to get its creditors to agree with its restructuring plan. Do you see parallels in your negotiations? We don’t know if they have succeeded or failed. There has been no official confirmation. Although we may have common lessors, each airline has different considerations. We are all different. Sometimes, we feel like an unwanted child. So, maybe the lessors will be kinder to us.

The Malaysia Airlines CEO was recently quoted as saying he is not crazy enough to contemplate a merger with AAX with you having RM63.5bil of debts. Do you agree?

I completely agree. Two wrongs don’t make a right. There will be no good outcome for anyone to merge two airlines in dire straits.

How will failed negotiations affect AirAsia Group? The converse is true. AAX needs a successful short-haul airline by way of AirAsia Group to thrive. The point-to-point medium and long-haul business is very competitive. But what our competitors do not have is an extensive fly-through network of routes. We can bring passengers from Melbourne to Male, Gold Coast to Guangzhou and Delhi to Denpasar. All on a single ticket and at one price.

AirAsia is known to go against the norm in its way of doing things and it has since pivoted away from just the airline business. Bearing the DNA of AirAsia, is there any room for pivotability in AAX’s business other than just low-cost medium to long-haul flights? You read our minds. It’s a whole new world out there. What was not possible before may now work. Cost has come off significantly. There are new opportunities. Planes are a lot cheaper. A good used A330 that was US$60mil before is now only US$25mil to US$30mil. Lease rates have come off significantly. We are exploring a few new areas we can operate in. Tremendously exciting. Watch the space. But all this will come to nought if we can’t get through this immediate next phase.

Do you really think you will succeed? There are a lot of naysayers. One bank we approached earlier to help us with this exercise did not want us to make an announcement on the restructuring without having approval for the scheme first. They do not believe it’s possible. They may be right. The stock price probably reflects that too.

It’s a tough call but we are far from being a lost cause. Our latest conversations with the major creditors in the last few days have been largely positive. They have been engaging, which is a good sign.

We are quietly optimistic that cold business sense will prevail over emotions and we hope to see this through.

Source: The Star, Oct 17, 2020