The House of Representatives on Wednesday unanimously passed a bill that sets the stage for delisting Chinese companies on U.S. exchanges, including electric-vehicle makers such as XPeng, and Li Auto.

NIO (ticker: NIO) the other highly valued U.S. listed Chinese EV player, believes it’s in compliance with the new law, according to a spokeswoman.

All foreign companies with U.S. stock listings have to comply with U.S. audit oversight rules within a three-year window.

Li Auto’s (LI) prospectus illustrates the issue: “The audit report included in this prospectus is prepared by an auditor who is not inspected by the PCAOB and, as such, our investors are deprived of the benefits of such inspection.” The PCAOB is the Public Company Accounting Oversight Board.

“In addition, the adoption of any rules, legislations or other efforts to increase U.S. regulatory access to audit information could cause uncertainty, and we could be delisted if we are unable to meet the PCAOB inspection requirement in time.”

That language was included in Li’s Dec. 2 Securities and Exchange Commission filing. Similar language is part of XPeng and NIO SEC filings from August.

All three U.S. listed Chinese EV stocks are reacting in after-hours trading, moving lower, but the declines are small, compared with recent gains. The muted reaction seems to indicate investors expect things to work out over time.

NIO stock (ticker: NIO) is down about 2.8% in after hours trading. XPeng shares (XPEV) are down 3%. Li Auto shares (LI) are down 0.7%.

Investors might be surprised, given the stock decline, to hear NIO believes it is compliant. That appears to be the situation. NIO’s spokeswoman responded to an emailed statement from Barron’s saying NIO was aware of the situation and became compliant over the past few months.

Representatives from XPeng and Li weren’t immediately available for comment.

Investors will pay close attention to all three companies. The Chinese EV players only have a U.S. stock listing. Other Chinese companies—potentially impacted by the bill expected to be signed into law by President Trump—are listed in multiple jurisdictions. That gives other companies a little more flexibility. Still, all companies have a long time to comply.

What a Ride

Most of the research analysts covering the three U.S. listed Chinese EV stocks are based in Hong Kong or China and haven’t been writing about the issue yet. Investors should expect updates in coming days.

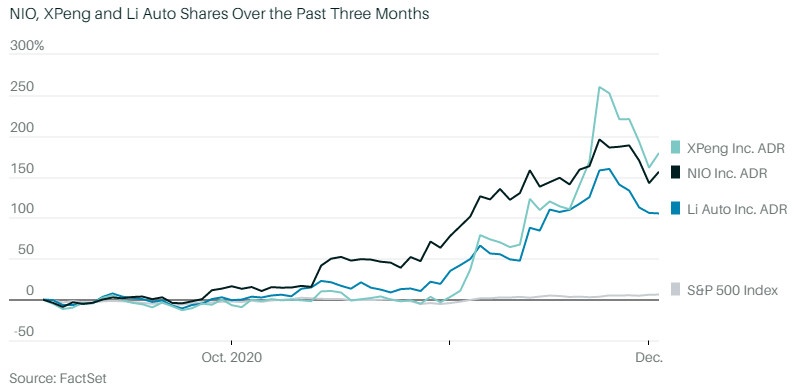

Chinese EV stocks have been investor favorites so far in 2020. The three stocks are up 133% on average over the past three months, crushing comparable returns of the S&P 500 and Dow Jones Industrial Average.

Source: marketwatch.com, 2 Dec 2020