Summary

- Shares trend lower as oil can’t break out.

- Cash dividend to Buffett is a curious move.

- Next debt raise will be interesting to watch.

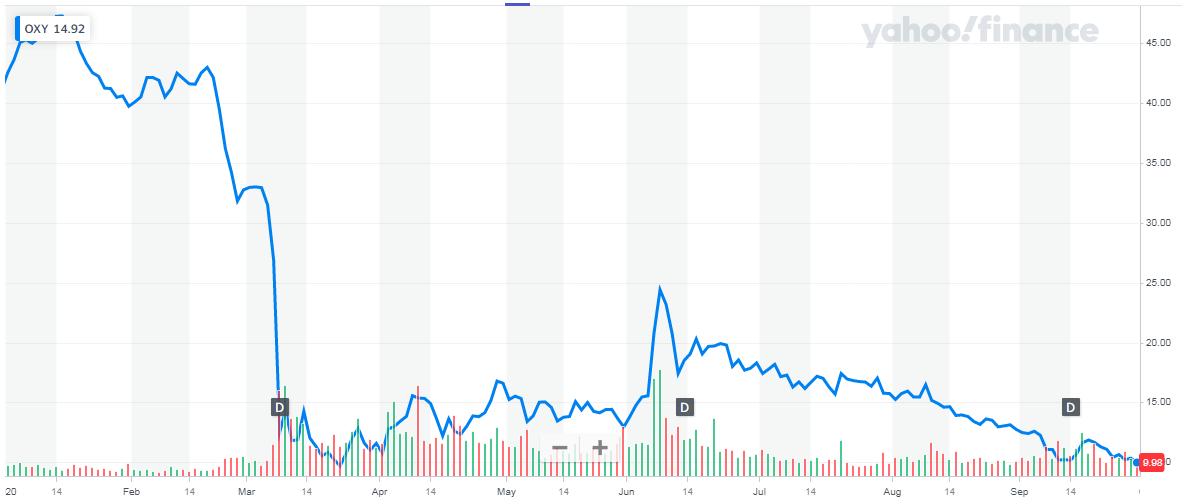

About a month ago, I detailed how shares of Occidental Petroleum (OXY) could easily see the single digits again. Oil prices just were not breaking higher, despite normally positive catalysts such as an improving US economy and multiple Gulf of Mexico tropical systems.

On Tuesday, shares in fact fell below the $10 mark, and they now sit less than a dollar away from the stock’s multi-year low.

Interestingly enough, Occidental shares have only closed below $10 once this year. That came on March 23rd, and on that day, WTI Oil closed at $23.36 and Brent closed at $27.03. Roughly six months later, those two commodities are trading at much higher levels, and yet Occidental shares are back to where they started. The market seems to be telling us something, and Tuesday’s news regarding a drilling setback in Colorado is only adding to downward pressure on the stock.

Investors will look at the situation and tell us that the company has made a lot of progress. Slashing the dividend to a penny per quarter per share certainly helped preserve cash, and the company has made multiple debt moves to address the mountain of debt that was due in 2020, 2021, and 2022. On the flip side, the company has been redeeming a lot of low interest rate debt, and thanks to its weaker financial situation, replacing it with higher rate debt. Thus, certain operating cost savings that have been achieved have been offset by higher interest expenses.

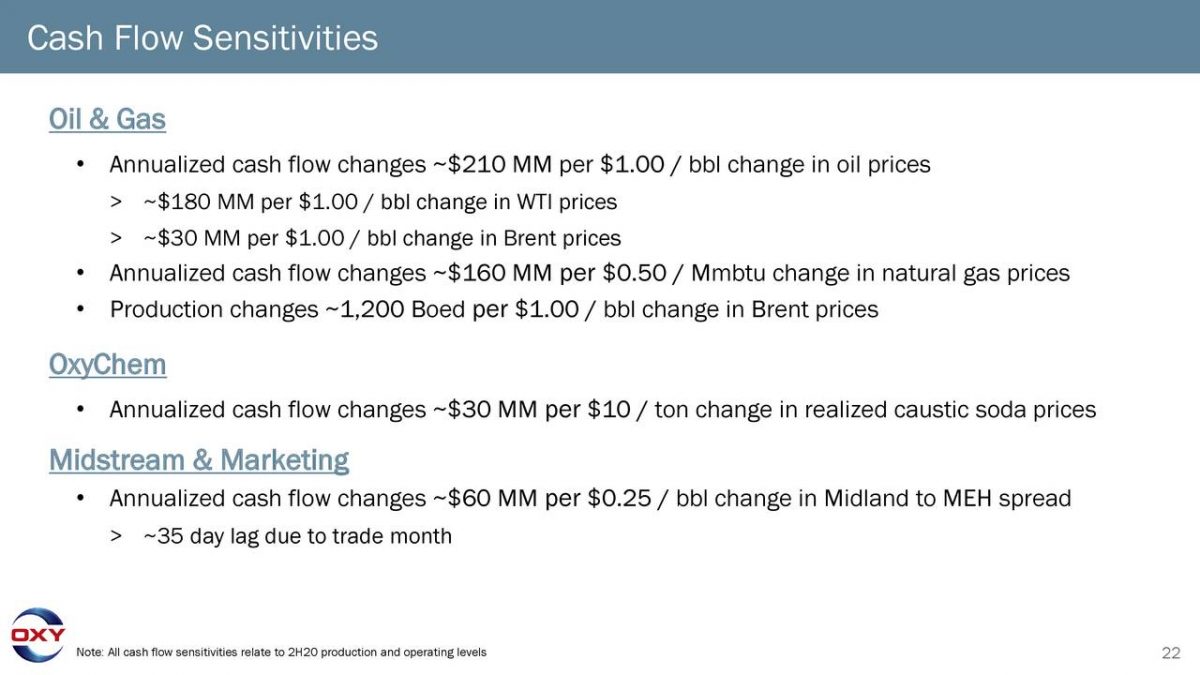

In the Q2 earnings presentation, slide 11, management said it would generate free cash flow in the second half of the year. That was based on current strip prices at the end of July. However, if you use the cash flow sensitivity slide below, along with current prices, Occidental would be down about $70 million per quarter in cash flow just from oil and gas. This does not count any other business moves made since then, like the debt sale and repurchase tender offers, or any potential oil production declines at these lower prices.

It will be interesting to see the Q3 update on all of this, especially if oil prices continue to head back to the mid $30s. On the other side of things, a major debt update will be provided, and we’ll see if the company drew down any of its credit facility to pay back debts maturing in the near term. There are some asset sales that will bring in cash, although they aren’t expected to close until Q4 at the earliest.

Given the company’s financial situation, the recent announcement to pay the preferred dividend to Warren Buffett in cash seems rather curious. While investors and analysts might think this is a positive sign, stock prices would tell us otherwise. While $200 million won’t break the company anytime soon, a little more dilution for that extra financial flexibility may have been a wiser move until the company can truly get back on solid ground. Yes, the credit facility is certainly available for use, but why pay interest expenses just in order to pay a dividend in cash?

If Occidental needs to tap the debt markets again, it may not achieve such favorable terms as its last offering. Since the day that the last debt deal was priced, high yield spreads are up about 25 basis points, while the 10-Year US Treasury is down about 6 basis points. That deal’s pricing document was filed on August 14th, and Occidental closed at $14.64 that day. With shares losing almost a third of their value since, how much more of a risk premium would bond investors want this time around?

In the end, Occidental shares have found the single digits again, showing how investors have little confidence in the name’s situation. Oil prices have soared since the last time shares closed in the single digits, and bond maturities have been pushed out, but equity investors aren’t buying. With that key commodity failing to break out recently, cash flow generation will be limited, and another bond offering may be quite painful. It’s not far-fetched to think Occidental will hit a new multi-year low in the near term, especially if oil prices continue trending lower.

Source: SeekingAlpha, 29 Sep 2020