Summary

- The worst may be over for Occidental.

- Occidental probably needs at least average WTI prices in the next fiscal year and the years after that to deleverage.

- Coronavirus demand destruction and the OPEC price war changed a viable deleveraging plan into a very speculative one.

- In more normal industry times, the preferred stock requirements and additional debt would have been more than offset by the cash flow of the acquired properties.

- The debt due schedule went from routine to extremely challenging. So far, management has been up to the challenge.

Occidental Petroleum (NYSE:OXY) appears to have weathered the worst of fiscal year 2020. Now, if the company can get the original deleveraging program back on track, then there is still a good chance for the company to benefit from the acquisition.

No one saw the coronavirus demand destruction when the bidding for Anadarko Petroleum began. Had that been the case, obviously, the bidding, if any, would have been very different.

Now, though, it might be time to look at the “casino stocks” that have a reasonable chance of heading towards investment-grade designation.

Occidental Petroleum is one of those stocks.

The acquisition did make Occidental more leveraged. However, the acquisition also added cash flow. Should oil prices rise and stabilize at a decent level, then Occidental cash flow could be sufficient.

More decent oil prices should also allow the resumption of asset sales. This investment would have to be based upon the idea that the company can begin deleveraging in a sufficient amount of time and obtain decent cash flow from the assets.

I have covered companies like Cenovus Energy (NYSE:CVE) all through the purchase and deleveraging effort to know that the initial idea behind the Occidental takeover bid was not all that radical. From the interest rates on the bonds at the time, the lending market considered the whole management plan reasonable.

However, the OPEC pricing war followed by the coronavirus demand destruction turned many initial ideas and management plans about the unfolding of the acquisition into impossible dreams overnight. Management literally had to deal with lower commodity prices and a crashing asset sales market before they ever really got to step one of the deleveraging plan.

What may have been seen by the lending market as reasonable in 2019 has now been extensively revisited and re-evaluated.

Now, with the recovery from the coronavirus demand destruction underway (even if that recovery is at best halting), there appears to be enough certainty on the long-term horizon to begin a new plan to deleverage and restore some balance sheet strength.

In the meantime, the coronavirus experience may change the takeover game for years to come. Safe debt ratios appear to have been re-evaluated by the market downward.

The oil & gas industry did go into the current downturn in much better shape than in the past, thanks to the 2016 experience. However, there were some survivors of the 2016 washout that got carried away this time to reorganize. Many others managed to deleverage very quickly. Therefore, those companies went into the current downturn much financially stronger than they have been in years.

As long as the recovery from the coronavirus demand destruction does not take “years”, Occidental should still be able to carry out a reasonable deleveraging plan.

Finances

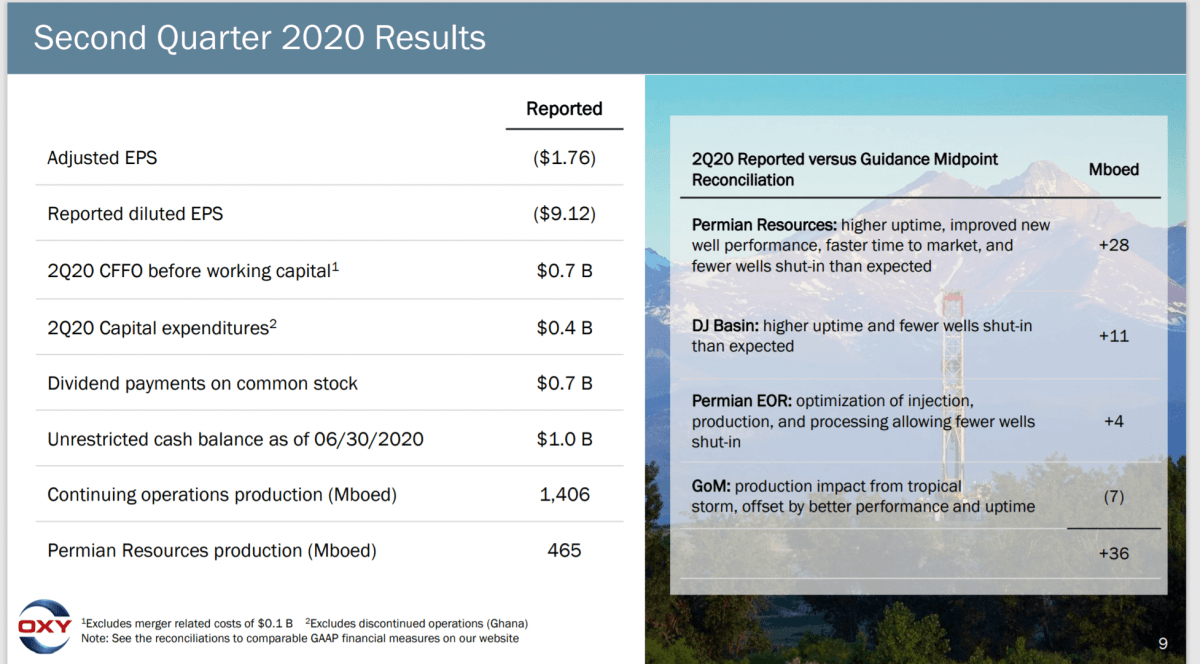

Cash flow was nothing close to planned. The second quarter, in particular, will probably be an industry outlier for years to come.

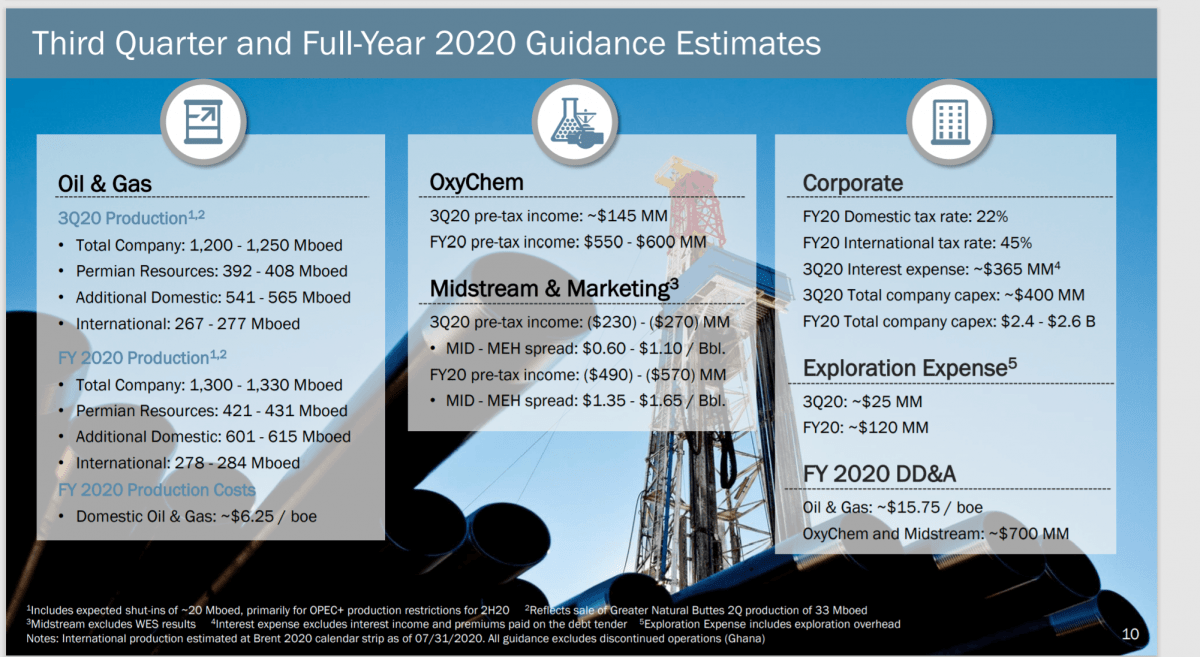

The company reported less than $1 billion in cash flow from operating activities. There is every chance that the third and fourth quarters will have considerably more cash flow. Oil and natural gas pricing is not great at the current time. But that pricing appears to be far stronger than it was in the first half.

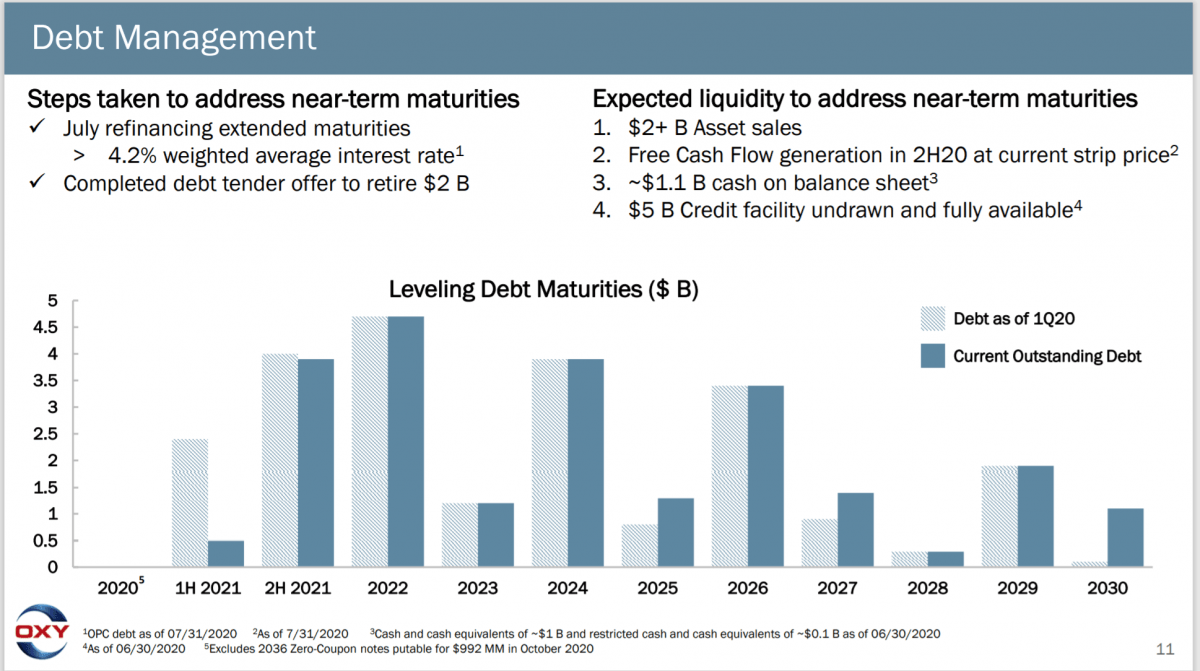

In the meantime, management had to rearrange the debt due under some very hostile industry conditions. Management was able to successfully sell some new bonds to pay off debt coming due. But the price to accomplish that was a higher interest rate.

Stronger oil prices are probably needed within the next year to generate more cash flow which would allow the refinancing of more debt coming due. Ironically, last year, this debt due did not look like a big deal as Occidental had a decent credit rating, and the debt was reasonable.

But what looked a “slam dunk” has become a real challenge due to the coronavirus demand destruction. Many companies are hoping that next year will approach normal. For this company, next year has to approach average at least.

Far more importantly, Mr. Market needs to see an average future without the coronavirus demand destruction and without the threat of an OPEC price war. Then, the market to sell properties should open to the point that this company could make some solid progress repaying debt due.

Diversification Needed

Occidental greatly enlarged its chemicals division through a joint venture plant near the Mexican border. However, this company clearly has a lot more diversification needed for less volatile long-term results.

The production costs of less than $10 BOE are important because this company will cash flow at very low commodity pricing. Cash flow means surviving, and that is the key until the original plan can be executed.

However, the company needs other divisions or expansion of the divisions that it has to reduce the volatility of the upstream business. The midstream and marketing shown above definitely help the cause. But those results when combined with the burgeoning chemicals business do not offset the weakness in the major upstream business because those divisions are simply too small.

This company really needs oil prices of at least WTI $48 to execute the current deleveraging plan while providing sufficient cash flow to execute that plan. At that point, the acquisition costs and the preferred stock requirements should be offset by sufficient (but maybe not satisfactory yet) cash flow.

Conclusion

Occidental Petroleum has the potential to offer investors some extremely attractive long-term appreciation returns. But the near-term results may be “dicey”. Therefore, the investors who like to invest rather than (or in addition to) going to the casino may want to consider the common. Others may decide to initiate a position in the bonds or the warrants first. It is really a matter of personal choice and risk tolerance.

In the meantime, if the company gets through the next 12 months, then there is a far better chance that the five-year return will be enticing. However, moderate risk and conservative investors should probably look elsewhere (or only use their coffee or lottery ticket money). A situation that no one really saw coming has turned the current opportunity to invest in Occidental into a speculative opportunity or even a highly speculative opportunity.

Surviving the second quarter may have been the “watershed event”. However, the way the coronavirus pandemic is trending in the United States, there could be a prolonged period of weak industry pricing that would seriously damage the company prospects.

Once the coronavirus challenges are in the rearview mirror, then this company can go back to the original plan for deleveraging. Getting to that future will be a definite challenge for management, though.

Source: SeekingAlpha, 21 Oct 2020