Summary

- Occidental Petroleum has recently announced tender offers for another $3 billion in debt – paying off a significant portion of its next several year debt load.

- The company has an impressive portfolio of assets and continued impressive cash flow generation.

- Over the next 11 years, the company can see its share price double every < 4 years.

Occidental Petroleum (NYSE: OXY) has suffered along with the remainder of the oil markets. Since early-June, the company has seen its share price drop by more than 50%, despite no major negative changes. However, as we’ll see throughout this article, the company’s continued improvements of its financial picture make it a valuable long-term investment.

Occidental Petroleum Debt Improvement

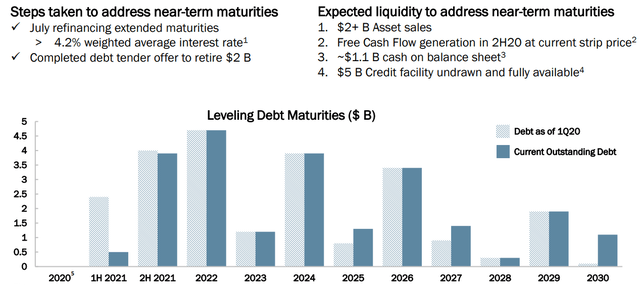

Occidental Petroleum has significantly improved its overall debt maturity profile.

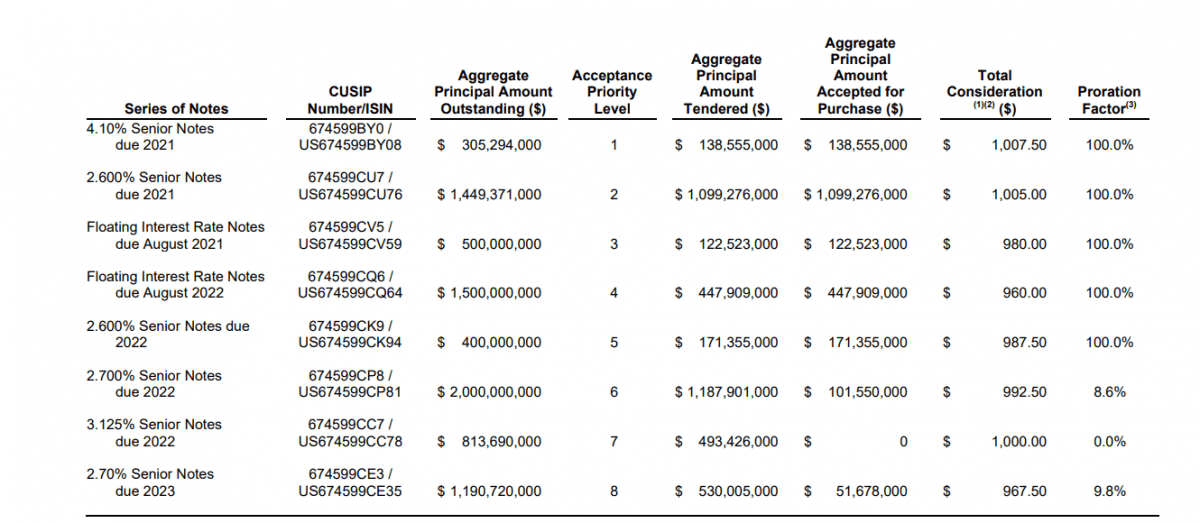

Occidental Petroleum has recently announced major tender offers for up to $3 billion in debt due in 2021, 2022, and 2023. The company currently has $10 billion in debt due across this 3 year time period, meaning its alleviating 30% of its debt due over this time period. The company continues to accept offers and has so far received the offers in the table below.

Occidental Petroleum has received roughly $2.1 billion in aggregate amounts accepted for purchase and has roughly $1.1 billion more tendered that it hasn’t chosen to purchase yet. The specific aspects worth paying attention to is the company has $1.4 billion in 2021 debt accepted, $700 million in 2022 debt accepted, and $50 million in 2023 debt.

Across the board, this debt that the company has tendered, $2.1 billion worth, will save it roughly $60 million in annual interest expenses.More so, the important part to look at is the company has solved ~30% of 2021 debt, ~15% of 2022 debt, and ~5% of 2023 debt. That’s a massive improvement across the board in the company’s debt profile.

With the company’s massive debt improvements, especially given its expected to be FCF positive in 2H 2020, $2+ billion in asset sales, and >$6 billion in liquidity, its well positioned to handle the next several year debt cliff. At the same time, we’ll discuss the overall strength of the company’s cash flow in coming years.

Occidental Petroleum Capital Spending Improvements

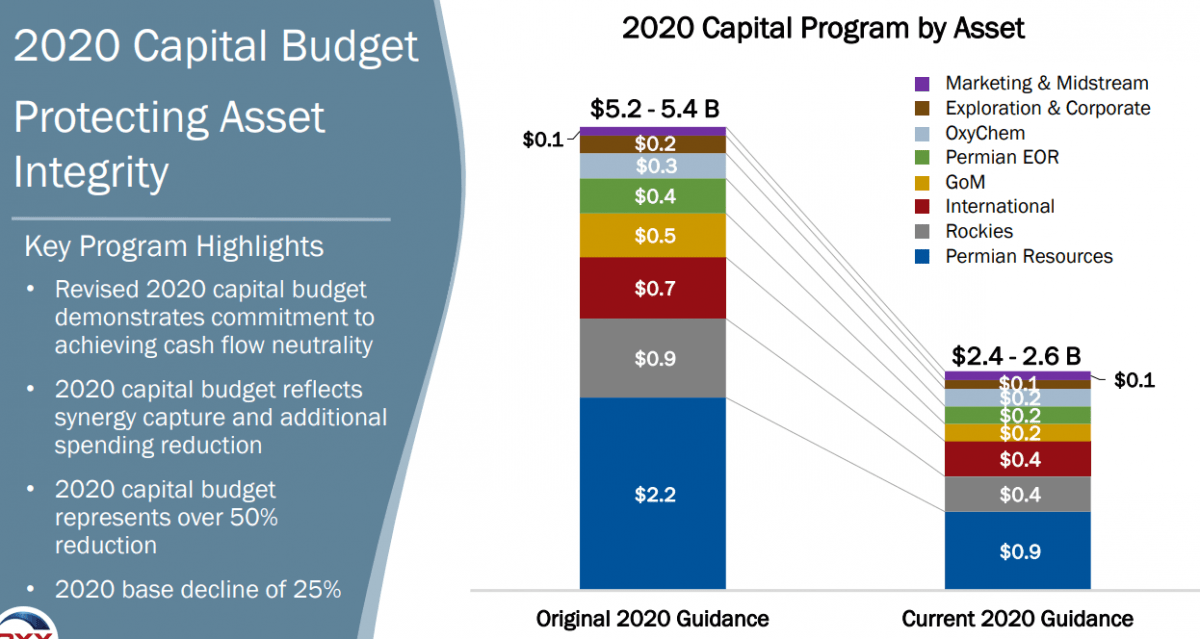

Occidental Petroleum has dramatically improved its capital spending and expenditures in the coming years.

Occidental Petroleum has dramatically cut its capital program from $5.3 billion to $2.5 billion. That comes with a 50% reduction and a 25% base decline for the company. Across the board, the company is cutting its production and focusing on high value production. This comes with the company’s additional $600 million in operational expenditures.

Overall, the company is focusing on its highest value assets, trying to maximize cash as it pays-down debt. The company has the ability to cut its capital spending much further in 2021, although, whether it chooses to go down this path is dependent on the price scenario. The company’s old sustaining capital was roughly $3.4 billion.

Going forward, the company’s new sustaining capital under the new asset base will be roughly $2.9 billion.

Occidental Petroleum Low Cost Asset Base

Occidental Petroleum plans to take advantage of a $40 WTI breakeven on its old dividend with its new sustaining capital. The company’s old dividend was roughly $3 billion and the company’s capital savings are roughly $0.5 billion annualized. Combined with operational savings, that’s more than $4 billion in fresh annual cash flow savings after capital spending.

That $4 billion takes advantage of the company’s incredibly impressive and low cost asset base. That $4 billion means $12 billion in cash flow over the 2021-2023 time period. That number will likely be closer to $10 billion counting the company’s production declines. However, that’s more than enough for the company to handle its debt.

More importantly, it doesn’t require additional asset sales or capital raises. That highlights the strength of the company’s low cost asset base. Occidental Petroleum continues to be held back by its $36 billion in long-term debt, $10 billion in preferred equity, and the difficulties that oil prices continue to face due to COVID-19.

However, the company has significant cash flow strength. Each $3 billion in debt it pays down saves it roughly $150 million annualized and each $3 billion in preferred equity it pays down saves it roughly $250 million annually. Over the next 5 years, we expect management to undergo an aggressive debt pay-down scheme.

Assuming it maintains production from its impressive low cost asset base, it can emerge in 2025, with only $21 billion in long-term debt and $750 million in fresh annual cash flow. Very long-term, the company can emerge in 2035 with no debt or preferred equity and more than $5 billion in annual cash flow. Even with the 15-year time frame, given the company’s $10 billion current market capitalization, the potential for long-term shareholder returns is substantial.

Occidental Petroleum Shareholder Return Potential

Here, the evidence for Occidental Petroleum’s shareholder potential becomes clear. We assume that the company adopts a policy of solely paying off its debt and preferred equity, with no other shareholder rewards in the meantime. The net cost to the company throughout this time is $46 billion. The company starts with $3 billion growing towards $5.5 billion.

That means $4.2 billion average, or a roughly 11-year payoff. That means that in 2032 the company will have $5.5 billion in annual free cash flow. That comfortably means a valuation of $80 billion at a 15x FCF multiple. That means 3 doubling in value in 11-years, or doubling less than every 4 years on average.

That means significant shareholder returns for those who invest today.

Occidental Petroleum Risk

Occidental Petroleum’s risk is quite simple. The company suffers from the potential of a long-term secular decline in oil prices, or short-term collapses caused by COVID-19. Both place the company in a difficult position in terms of its ability to reward shareholders long-term. While the company can perform well at $40 WTI, it struggles at $30 WTI.

At $50+ WTI it outperforms long-term. We believe that oil prices have significant potential to recover. However, this is a continued risk investors should pay attention to.

Conclusion

Occidental Petroleum has an impressive portfolio of well distributed assets. The company has made a number of improvements throughout the year and is well positioned for 2021, with its $2.9 billion in annual sustaining capital going forward and significantly improved portfolio. The company expects to be FCF positive going forward.

Even if the company adopts a position of no shareholder rewards, and simply pays off debt and other expenses, it stands to reward shareholders incredibly well going forward. The company maintains the risk of a long-term decline in oil prices, however, at this time the fundamentals for shareholder returns are sound.

Source: seekingalpha.com