Summary

- Occidental Petroleum has an impressive low cost portfolio of assets, supported by prior year capital spending.

- The company recently announced it would pay its $200 million quarterly payment to Warren Buffett in cash. That’s a sign of financial strength.

- The company continues to have a significant amount of debt, but that debt is manageable. Managing that debt could actually result in enormous shareholder returns, despite anything else.

- Occidental Petroleum’s shareholder returns in the coming years depend heavily on OPEC+ maintaining production cuts.

Occidental Petroleum (NYSE: OXY) is a company we’ve discussed numerous times previously. The company is the classic example of companies affected by the crude oil collapse. It underwent the major acquisition of Anadarko Petroleum, outbidding Chevron (NYSE: CVX) prior to the crude oil collapse. However, the company appears to be on the path to improvement, something we’ll discuss throughout this article.

Occidental Petroleum and Warren Buffett

Occidental Petroleum needed to appeal to Anadarko Petroleum shareholders to convince them to allow the company to acquire Anadarko. Simultaneously, the company needed to avoid issuing too much equity in the acquisition, which would risk the acquisition not passing due to a shareholder vote. As a result, the company needed to turn towards a new source of capital.

Legendary value investor Warren Buffett smelled an opportunity and decided to pounce. He arranged a deal with Occidental Petroleum where the company provided $10 billion in the form of 100 thousand shares of preferred equity at $100 thousand each. Each share would pay $8000 (8%) in annual dividend for shareholders.

Additionally, the shares could be redeemed in less than a decade at a 5% premium. Lastly, Warren Buffett has the opportunity to invest in 80 million shares of Occidental Petroleum at a $62.5 share price. That’s well below current shares. The one last covenant is Occidental Petroleum can issue equity instead of cash to pay the interest, but at a 10% premium.

Occidental Petroleum suffered through the collapse. As cash flow issues mounted, the company chose to issue Warren Buffett equity. It was focused on preserving capital however possible for the company. Since then, however, the company has announced it’s paying the next batch in cash. That implies a dramatically improving financial position for the company.

Occidental Petroleum Asset Portfolio

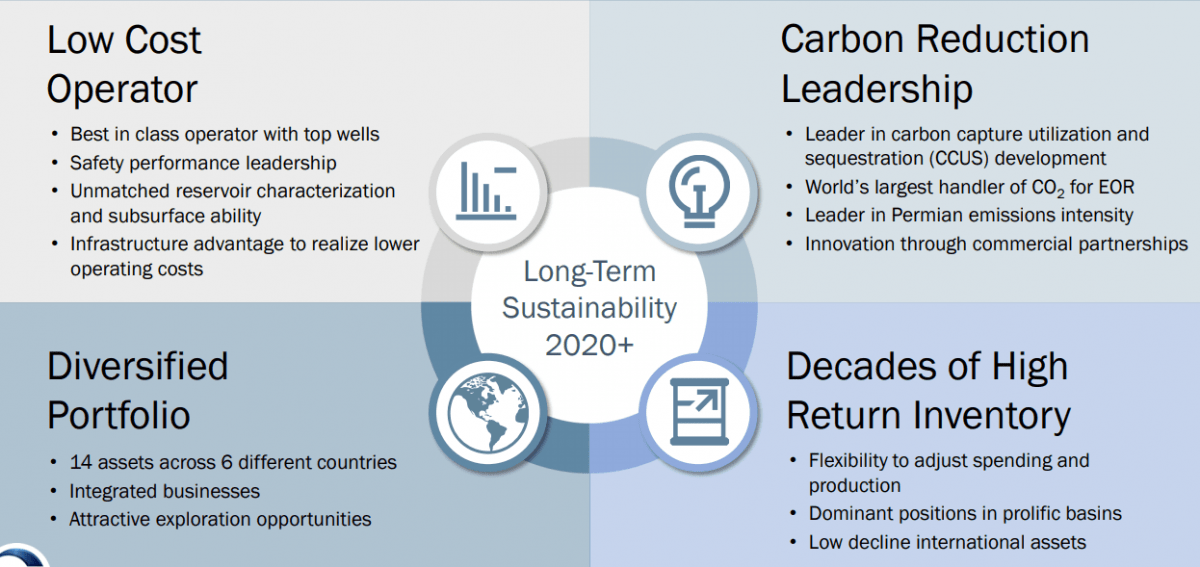

Occidental Petroleum has an impressive asset portfolio that justify the company’s long-term cash flow.

Occidental Petroleum is a best in class Permian Basin operator, as the Permian Basin is becoming one of the lowest cost operating regions in the world. The company is a best in class operator with top-tier wells, continued focus on performance leadership, and the infrastructure to continue lowering its operating costs.

The company, past the Permian Basin, has a number of assets spread across a number of different major businesses. Going forward, it has the potential to earn high returns for decades to come, with its low decline assets in prolific basins. The company remains a leader in carbon reduction past that, supporting its appearance in an unpopular industry.

Overall, the company’s asset base with mid-single digit operating expenditures, and multi-decade environment, will support cash flow in any long-term oil environment.

Occidental Petroleum Cash Flow Improvements

That cash flow for Occidental Petroleum support the company and the potential for substantial future returns.

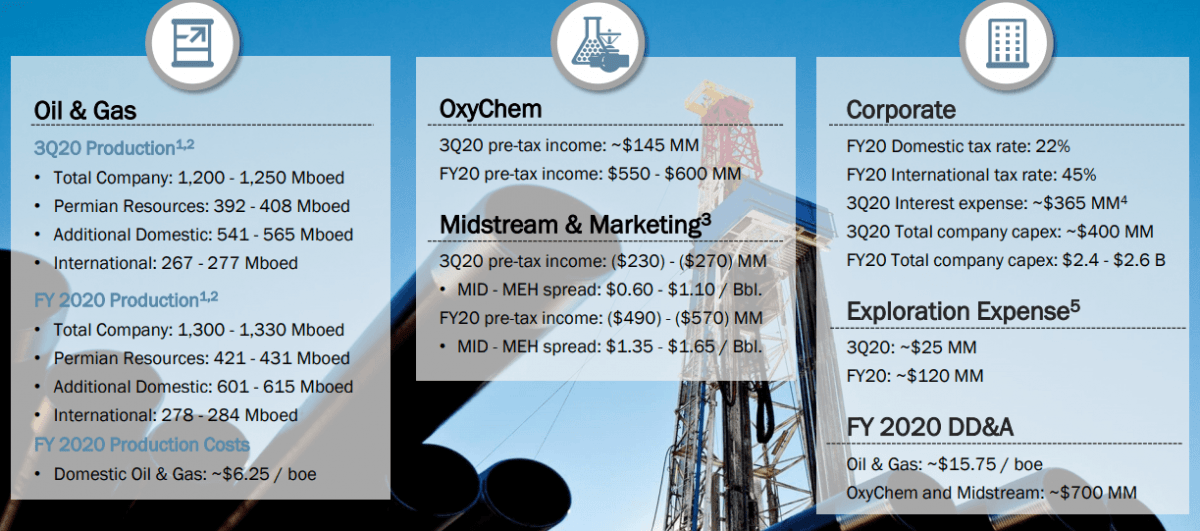

Occidental Petroleum now forecasts 3Q 2020 production at roughly 1.225 million barrels / day, roughly 33% of which is through the Permian Basin. FY 2020 production is expected to be substantially higher, thanks to the company’s strong start to the year. Going forward, the decline in capital spending will keep that rate lower in the coming years.

The company’s tax rates remain low and the company’s capital expenditures will be roughly $625 million / quarter. Out of that, the vast majority is maintenance spending at the company’s new levels. The company’s chemical business will continue to earn respectable income, while the company’s midstream business continues to suffer.

The company continues to maintain a strong cash flow. Prior to 2020, the company’s guidance was dividend breakeven at $40 WTI. The company’s old dividend was roughly $3 billion annualized which was covered under this. At the same time, its production has dropped with its capital spending, which has changed its cash flow profile.

It’s also worth noting here that the company’s production costs are incredibly low. That means a significant part of the company’s expenses are in terms of capital expenditures the company spent in earlier years. That means that the company, when it needs more cash flow, will earn that more in the current year.

Occidental Petroleum Debt Management

Occidental Petroleum is focused on managing its debt, which is what devastated the company significantly. The company was once at roughly 8x its current market capitalization.

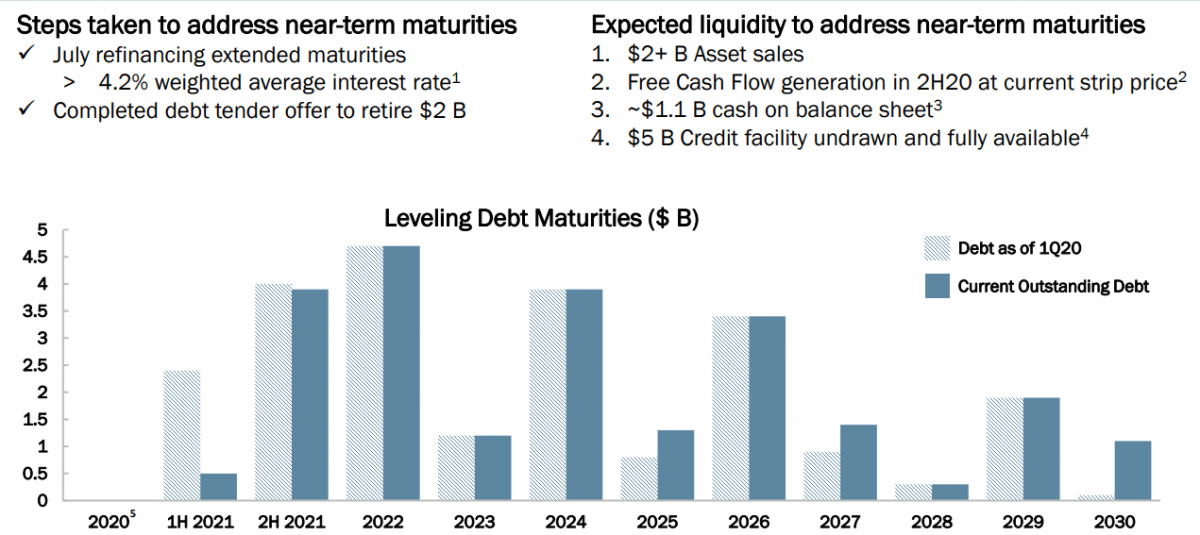

Occidental Petroleum continues to have an incredibly low interest rate on its debt at a 4.2% weighted average interest rate. The company has recently completed a debt tender offer to retire $2 billion, and it’s continuing to position itself for its debt maturities. The company needs to get over its significant hurdles for near-term debt.

From 2021-2024, the 4 year period, the company has $14 billion in debt due. That’s more than its current market capitalization. Managing to pay off the debt also means the company will save $600 million in annualized interest rates (6% of its market capitalization) each year. Lastly, the company has levers to handle near term emergencies.

The company has $2+ billion in asset sales it’s focused on and expects to be FCF positive going forward. The company has $1.1 billion in cash on its balance sheet and $5 billion in an undrawn and fully available credit facility. That will support the company through 2021. What actually matters for the company is removing its dividend to get several billion in annual cash flow.

That’s substantial because it’s enough to cover the debt over the 4 years. That’s what was possible for the company at $40 WTI. It’s also worth noting that the 2020s stand to be the decade of substantial shareholder returns. The company has $22 billion in debt due over this time period, double its market capitalization.

That means, if the company pays off all its debt, but maintains its enterprise value, it stands to triple its market capitalization over the decade. More so, with 2025 as a low year, and 2026 as the only spike year in the second half of the decade, if the company can perform until 2024, it can perform until end of the decade.

Occidental Petroleum Risk

Occidental Petroleum’s risk is quite obvious and straight forward at this point. The company continues to face the risk of lower energy prices. The company paying the $200 million quarterly installment to Warren Buffett in terms of cash instead of equity, highlights the improvement in its cash flow and its belief in continued strength in oil prices.

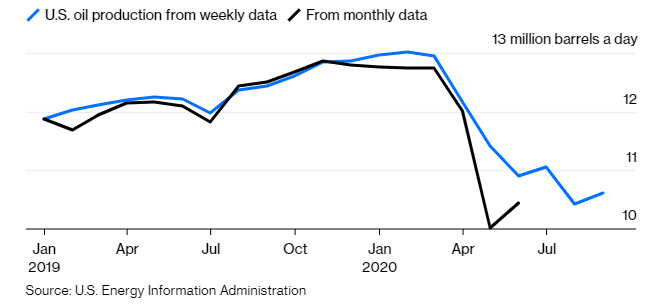

In our view, the largest risk to oil prices is OPEC+ and its production cuts. Specifically, whether OPEC+ chooses to maintain its massive production cuts. Due to the drop in capital spending, U.S. oil production has dropped by nearly 3 million barrels / day. That will remain lower for longer, even as demand recovers.

However, OPEC+ cut its production by 10 million barrels / day, with the rights to increase the decline in production to a 6 million barrel / day decrease in early-2021. OPEC+ can choose to maintain those declines in production, or they can choose to decrease them. It depends what price OPEC+ is comfortable with.

Previously, they were comfortable with $60+ / barrel. However, Russia also caused a major collapse recently, by not wanting to decrease production. What happens remains to be seen, however, it’s a major risk to Occidental Petroleum.

Our Investment Recommendation

Our investment recommendation is that investors take the opportunity to invest in Occidental Petroleum at current prices.

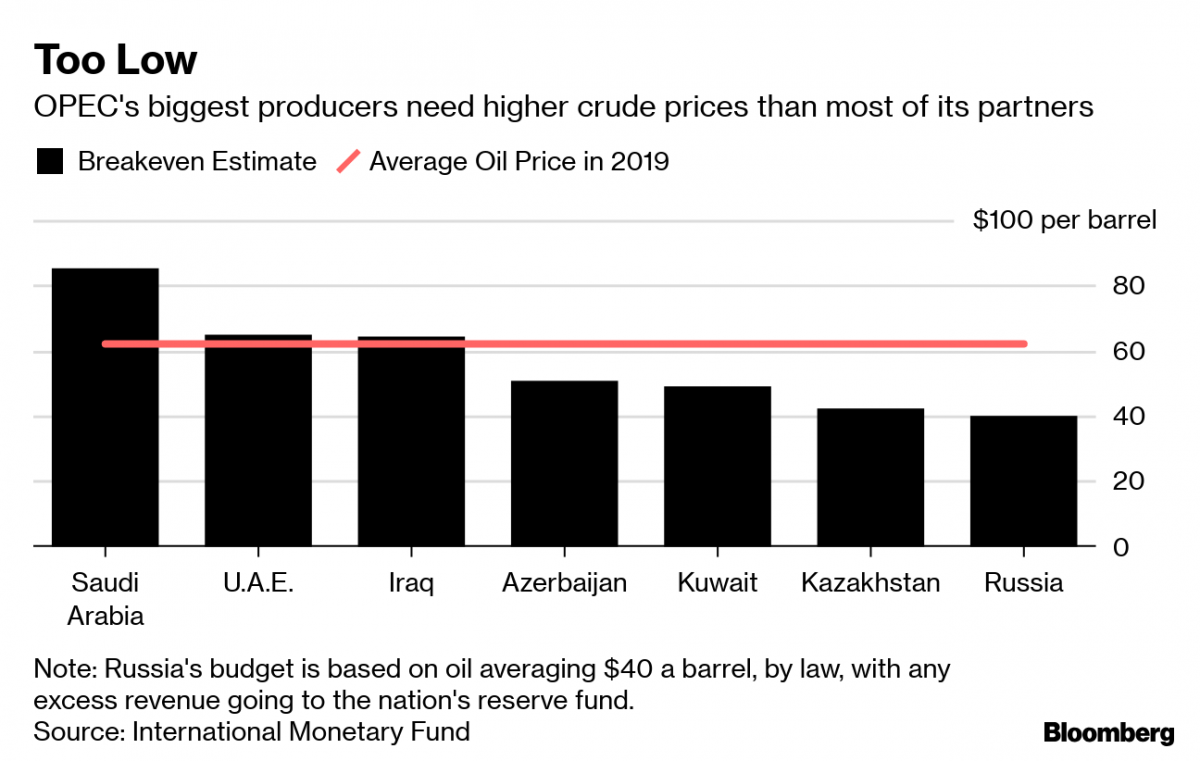

Analysts continue to discuss the low breakeven cost of OPEC+ countries, such as Saudi Arabia, where lifting costs or just a few dollars per barrel. However, they ignore the fact that these countries are primarily dictatorships. Dictatorships that provide significant social benefits for their leadership and their people.

As a result, these countries actually have a much higher breakeven rate. Russia has one of the lowest, but they still benefit significantly from crude prices in the neighborhood of $60 / barrel. At that level, Occidental Petroleum is massively undervalued. We expect prices, over the coming years, to average at this new normal making investing now a strongly beneficial proposition.

Source: SeekingAlpha, 1 Oct, 2020