Investors brace for ‘blizzard of bad news’ as coronavirus pandemic grows

Published: March 31, 2020 at 8:13 p.m. ET, By William Watts

April will pose a crucial test for stock-market investors looking for signs that the worst of the market carnage triggered by the global COVID-19 pandemic is past, as the outbreak continues to claim lives and promises historic, near-term economic pain.

Bears contend the sheer uncertainty surrounding the impact of the pandemic is likely to pave the way to further waves of selling.

“The coming weeks will be a blizzard of bad news — both on the economy and public health,” said Zach Pandl, macro strategist at Goldman Sachs, in a Monday note. “We doubt that markets will be able to price out adverse tail risks against that backdrop, and new challenges might emerge, including sovereign downgrades, FX peg breaks, or a wave of business failures.”

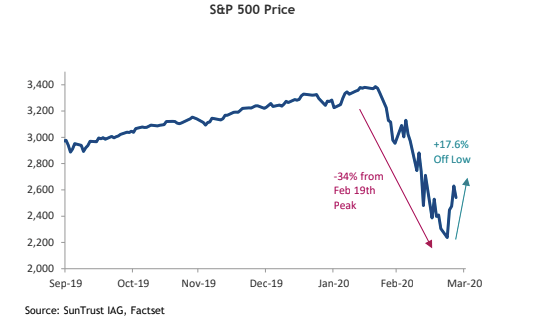

But some investors and analysts contend that while markets are likely to remain volatile, the stock market’s bounceback last week after tumbling with record speed from all-time highs into a bear market, gives hope that March 23 lows for major indexes may more or less hold.

Even hopeful investors often caution that bear markets are typically volatile and often see sharp rebounds before retesting lows or going on to decline even further before finding a bottom. But the fast and sizable policy response by central banks and governments have some market watchers arguing that the probability that the recent lows will hold may be better than in past major selloffs.

Keith Lerner, chief market strategist at SunTrust Advisory, said the lessons of past bear markets would normally lead him to place the probability of a retest of the market low somewhere between 70% and 80%. But he thinks the odds of a retest of the March 23 low are instead closer to 50/50.

“The market already knows that the economic data in the weeks and months ahead will be weak. The question is whether or not it will be worse than current expectations,” he said in a note.

For example, last week’s first-time weekly jobless claims figure soared past the previous record to top 3 million, yet markets rallied on the day, Lerner observed.

Stocks in early March completed a tumble into a bear market with record speed before bouncing sharply last week — a rebound that still left the Dow Jones Industrial Average with its biggest first-quarter decline DJIA on record with a 23.2% fall and its worst quarterly performance overall since 1987. The S&P 500 SPX saw a 20% first-quarter fall, its biggest since the final three months of 2008.

The Dow on March 23 finished at 18,591.93, its lowest close since Nov. 9, 2016, which left it with a pullback of more than 37% from its all-time closing high set in February. The S&P 500, on the same day, ended at 2,237.40, its lowest close since Dec. 6, 2016, marking a nearly 34% pullback from its record finish. The indexes then began a rebound that saw the Dow log its biggest three-day gain since 1931.

Lerner said the market is likely to remain volatile in coming weeks, but that long-term investors likely stood to be rewarded by delving back into the market. Following last week’s sharp upswing, he now calls for a gradual, averaging-in approach, using pullbacks to add exposure.

Meanwhile, bullish investors might take only limited comfort in April’s position as one of the strongest calendar months for equities.

First-quarter earnings season will also kick off in April. Analysts have struggled to pin down the effects of the pandemic on the just completed quarter and, in particular, what it means for the coming quarter.

Analysts now expect the S&P 500 to report a year-over-year 5.2% decline in first-quarter earnings, followed by a 10% decline in the second quarter and third-quarter fall of 1.1%, according to FactSet. Over the past week, the aggregate earnings growth rate for calendar-year 2020 changed from slight year-over-year earnings growth of 0.6% to a slight year-over-year earnings decline of less than 0.1%.

Source: www.marketwatch.com