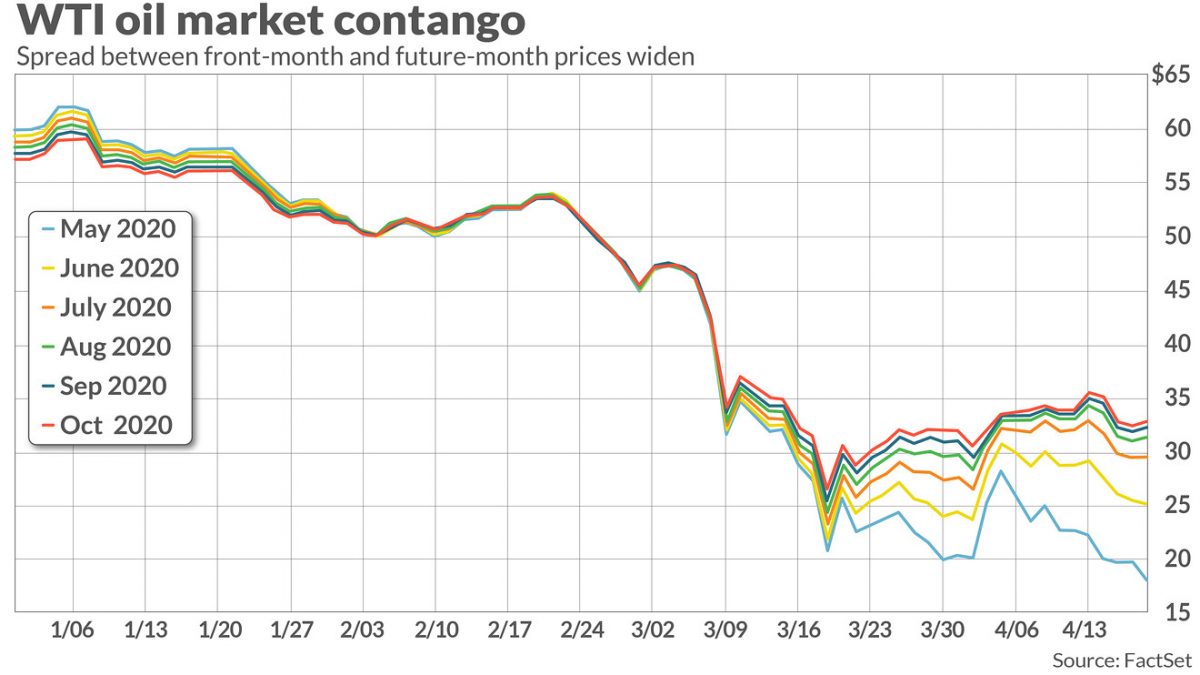

WTI price spread for front-month vs. later delivery contracts hit an 11-year high

Published: April 18, 2020 at 10:59 a.m. ET, By Myra P. Saefong

U.S. oil futures have dropped to their lowest since early 2002, but its the price spread between the front-month and future-month deliveries that’s caught investors’ attention this week.

West Texas Intermediate crude prices for future delivery have risen well above the spot market—a situation known as contango—and that can encourage traders to store oil.

“The historic contango is a reflection of physical barrels that can’t easily find buyers and are being sold at distressed prices,” Michael Lynch, president of Strategic Energy & Economic Research, told MarketWatch. “The implication is that storage might be more full than thought, or that buyers expect it to be very soon.”

The spreads on Tuesday between the front month and the contracts for later delivery were the largest since Feb. 12, 2009, according to Dow Jones Market Data, which tracked front month prices versus the next four months of future delivery prices. On that day, the front-month May West Texas Intermediate oil contract traded $14.45 a barrel below the September contract the data showed.

“The term structure of all crude benchmarks moved to a super contango in March, as massive oil demand destruction, significant refinery cuts and rising global oil supply were expected to create a large surplus in the oil market,” according to a monthly report from the Organization of the Petroleum Exporting Countries released on Thursday. “The market surplus was expected to reach around 15 [million barrels per day] in 2Q20, pushing prompt prices to decline much lower compared to longer-dated contracts.”

On Friday, May WTI crude, which expires at Tuesday’s settlement, settled at $18.27 a barrel on the New York Mercantile Exchange. The June contract, which will become the front month at May’s expiration, was at $28.08.

Marshall Steeves, energy markets analyst at IHS Markit, points out that the May WTI contract is trading below $20, but it expires next Tuesday whereas June is trading in the mid-$20s—and then the price curve moves back into the mid-$30s by the fall.

The steepest supply cuts by the Organization of the Petroleum Exporting Countries and its allies, collectively known as OPEC+, “take place in May and June, when the shutdowns in the U.S. and elsewhere are expected to remain in place and then slowly be lifted,” Steeves told MarketWatch.

OPEC+ reached an agreement on April 12 to cut overall crude-oil production by 9.7 million barrels a day starting on May 1 through June 30 of this year. Total cuts would then decline to around 8 million barrels a day from July 1 through Dec. 31, followed by a smaller 6 million barrels in cuts from Jan. 1, 2021 to April 30, 2022.

Ahead of those reductions, nearby WTI oil futures have declined on the back of “the extension of the stay-at-home directives in the Northeast states and some other places,” said Steeves, which would suggest a further fall in demand for oil.

Read: Nearby U.S. oil futures fall to lowest since 2001, pummeled as storage fears grow

Price spreads between nearby and deferred contracts for Brent crude, the global benchmark, aren’t as wide as those for WTI. Front-month June Brent settled at $28.08 a barrel on Friday, while its October contract traded at $35.95.

“Brent is a waterborne crude and not subject to the same storage constraints as WTI Cushing or WTI Midland” oil, said David Winans, principal, U.S. investment-grade credit research at PGIM Fixed Income. “WTI is a landlocked crude with fewer places to store, thus the front end price on WTI is getting clobbered the closer we go to ‘tank tops’.”

Crude stocks at the Nymex oil delivery hub at Cushing, Okla. sit at 55 million barrels, according to Ryan Fitzmaurice, commodity strategist at Rabobank, in a Friday note, adding that the all-time high is 69 million barrels set back in April 2017, though operational capacity “is stated to be just shy of 92 million barrels.

“This leaves 14mb before crude stocks at Cushing set a new record. and 37mb before max capacity is reached,” Fitzmaurice said. “At the current pace of ~5mb build per week, crude stocks will be overflowing in Cushing in less than two months’ time.”

Adding to that dilemma, U.S. crude supplies have climbed for 12 weeks in a row, with the increase of 19.2 million barrels reported by the Energy Information Administration for the week ended April 10 the largest weekly rise on record.

The supply gains come as demand is expected to see a record drop this year amid efforts to reduce the spread of COVID-19. The International Energy Agency estimated a drop in demand of 9.3 million barrels a day this year, equivalent to a decade’s worth of growth.

“The extreme contango is a reflection of market expectations that the current grossover supply in crude will work itself out,” Winans told MarketWatch. However, “near term, the imbalance is so great that U.S. oil storage could be exhausted, which really drives near term prices lower.”

Source: www.marketwatch.com